Latest drilling results from Kamoa’s Kakula,

which could prove to be Africa’s most significant

copper discovery, lead Ivanhoe’s project news

TORONTO, CANADA ‒ Ivanhoe Mines (TSX: IVN) today announced its financial results for the second quarter ended June 30, 2016. All figures are in US dollars unless otherwise stated.

HIGHLIGHTS

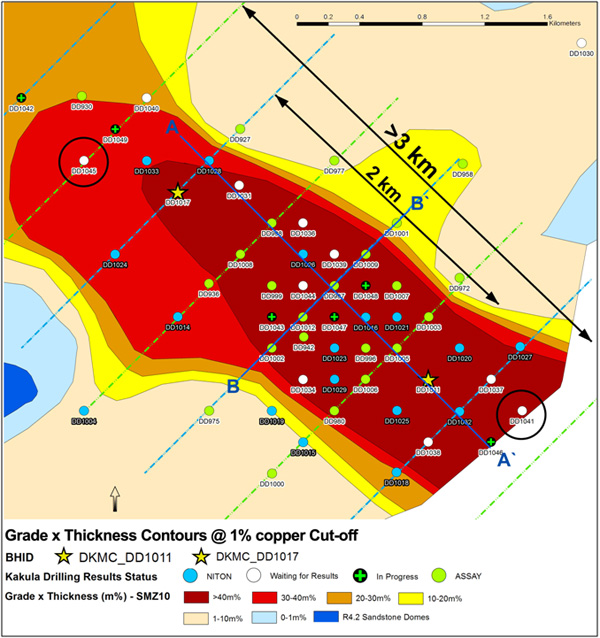

- On August 11, 2016, Ivanhoe Mines announced what could prove to be Africa’s most significant copper discovery at Kakula, on the Kamoa Copper Project, in the Democratic Republic of Congo (DRC). The massive, flat-lying, shallow, chalcocite-rich core of the Kakula Discovery zone now has been expanded to more than three kilometres in length – and still remains open in both directions.

- Based on the game-changing drill results received to date, Ivanhoe believes that Kakula’s copper discovery is substantially richer, thicker and more consistent than other known mineralization elsewhere on the Kamoa Project. The primary objective of the current drilling program at Kakula, which is using seven rigs, is to expand the thick, flat-lying, bottom-loaded zone of very high-grade, stratabound copper mineralization at the southern part of the discovery area that has the potential to be amenable to bulk, mechanized mining and to have a significant, positive impact on the Kamoa Project’s future development plans.

- Ivanhoe expects to receive an initial, independent Mineral Resource estimate for the Kakula Discovery around the end of Q3 2016. Upon receipt of the resource estimate, the Kamoa technical team plans to begin work on a preliminary economic assessment for Kakula.

- Underground mine development at Kamoa’s planned initial mining area at Kansoko Sud is progressing ahead of plan and within budgeted costs. The twin declines, incorporating both a service and a conveyor tunnel, each have advanced more than 130 metres since the first excavation blast was conducted in May of this year. Development of the underground mine is designed to reach the high-grade copper mineralization at the Kansoko Sud deposit during the first quarter of 2017.

- Initial metallurgical test results received in July 2016 from a sample of drill core from exploration drilling in the Kakula Discovery zone achieved copper recoveries of 86% and produced a copper concentrate with an extremely high grade of 53% copper. The results also indicate that material from Kamoa’s Kakula and Kansoko zones could be processed through the same concentrator plant, which would yield significant operational and economic efficiencies.

- Earlier metallurgical testwork indicated that the Kamoa concentrates contain extremely low arsenic levels, by world standards – approximately 0.02%. Given this critical competitive marketing advantage, Kamoa’s concentrates are expected to attract a significant premium from copper-concentrate traders for use in blending with concentrates from other mines. The Kamoa concentrates will help to enable the other concentrates to meet the limit of 0.5% arsenic imposed by Chinese smelters to meet China’s new environmental restrictions.

- Constructive and cordial negotiations are continuing between Ivanhoe Mines, its Kamoa joint-venture partner Zijin Mining Group Co., Ltd. and senior DRC government officials to complete the transfer to the DRC government of an additional 15% interest in the Kamoa Project, on terms to be negotiated. Ivanhoe expects a mutually beneficial agreement to be achieved in the near future that will provide long-lasting, positive benefits to the DRC government and the Congolese people.

- On July 8, 2016, Ivanhoe received the second installment of $41.2 million owing from a Zijin Mining subsidiary as part of a strategic co-development agreement under which Zijin acquired 49.5% of Ivanhoe’s majority stake in the Kamoa copper discovery. Zijin agreed to pay $412 million for a 49.5% interest in Ivanhoe subsidiary Kamoa Holding Limited that presently owns 95% of the Kamoa Project.

- Also in the DRC, on May 2, 2016, Ivanhoe Mines announced a positive preliminary economic assessment (PEA) for the redevelopment of the Kipushi zinc-copper-germanium-lead-silver mine. The PEA plan covers the redevelopment of Kipushi as an underground mine, producing an annual average of 530,000 tonnes of zinc concentrate over a 10-year mine life at a total cash cost, including copper by-product credits, of approximately $0.54 per pound of zinc. Successful planned restoration of production would make Kipushi the world’s highest grade, major zinc mine. A pre-feasibility study is underway that will further refine the optimal development scenario for the existing underground mine.

- On May 11, 2016, Ivanhoe Mines announced a 58% increase in Indicated Mineral Resources tonnage and a 21% increase in the Inferred Mineral Resources tonnage at its Platreef platinum-group metals (PGM), nickel, copper and gold project in South Africa. The new resource estimate is further confirmation of Ivanhoe’s belief that the deposit will be a model for safe, mechanized, underground platinum mining in South Africa.

- Platreef’s Indicated Resources now contain an estimated 42.0 million ounces of PGM plus gold, with an additional 52.8 million ounces in Inferred Resources, at the base-case cut-off grade of 2.0 grams per tonne (g/t) 3PE (platinum, palladium and rhodium) plus gold.

- At a lower cut-off grade of 1.0 g/t 3PE+gold, Platreef’s Indicated Resources now contain an estimated 58.8 million ounces of PGM plus gold, with an additional 94.3 million ounces in Inferred Resources.

- Platreef’s Shaft 1, which entered its permanent sinking phase last month, now has reached a depth of more than 70 metres below surface and is expected to reach the Flatreef Deposit at a depth of 777 metres below surface during the third quarter of 2017. Shaft 1 will provide early development access into the deposit and will be utilized to fast track production during the first phase of the project. Ivanhoe expects to start Shaft 2 early works in 2017, including civil work for the box cut and hitch foundation.

- Ivanhoe has made good progress on advancing the feasibility study for the first phase of development at Platreef. The study, which began in August 2015 and is being managed by DRA Global, is expected to be completed in early 2017.

- Ivanhoe Mines’ three projects achieved a combined 10.87 million hours of lost-time-injury-free (LTIF) work by the end of the second quarter of 2016. Ivanhoe had recorded 1.27 million LTIF hours at Platreef, 4.42 million hours at Kipushi and 5.18 million hours at Kamoa to the end of Q2 2016.

Principal projects and review of activities

1. Platreef Project

64%-owned by Ivanhoe Mines

South Africa

The Platreef Project is owned by Ivanplats (Pty) Ltd, which is 64%-owned by Ivanhoe Mines. A 26% interest is held by Ivanplats’ historically-disadvantaged broad-based, black economic empowerment (B-BBEE) partners, which include 20 local host communities with a total of approximately 150,000 people, project employees and local entrepreneurs.Ivanplats reconfirmed its Level 3 status in its second verification assessment on a B-BBEE scorecard. A Japanese consortium of ITOCHU Corporation and its affiliate, ITC Platinum, plus Japan Oil, Gas and Metals National Corporation and JGC Corporation, owns a 10% interest in Ivanplats, which it acquired in two tranches for a total investment of $290 million.

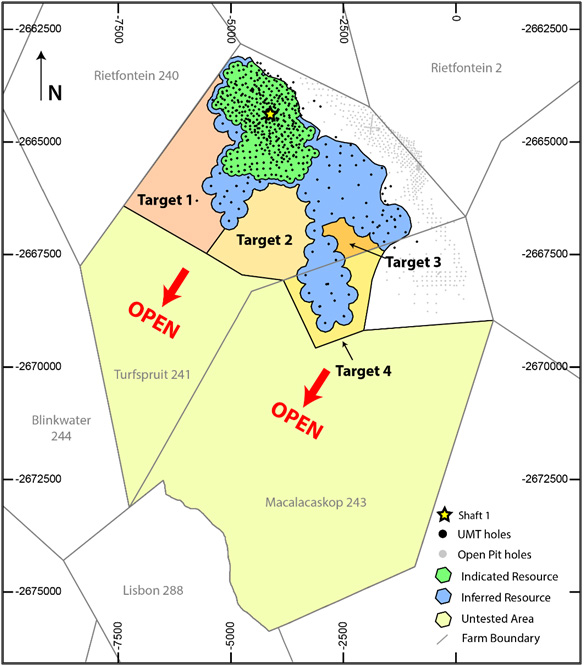

The Platreef Project hosts an underground deposit of thick, platinum-group metals, nickel, copper and gold mineralization in the Northern Limb of the Bushveld Igneous Complex, approximately 280 kilometres northeast of Johannesburg and eight kilometres from the town of Mokopane in Limpopo Province. Since 2007, Ivanhoe has focused its exploration activities on defining and advancing the down-dip extension of its original Platreef discovery, now known as the Flatreef Deposit, which is amenable to highly mechanized, underground mining methods. The Flatreef area lies entirely on the Turfspruit and Macalacaskop properties, which form part of the company’s mining right.

Updated estimates result in substantial increases in Indicated and Inferred

Mineral Resources at Platreef

On May 11, 2016, Ivanhoe Mines announced a substantial increase in Indicated and Inferred Mineral Resources at the Platreef Project. The updated Mineral Resource estimate, which included updated UMT_TCU Mineral Resources, Bikkuri Mineral Resources and the Mineral Resources in the immediate footwall of the TCU, was prepared by Ivanhoe Mines under the direction of Dr. Harry Parker, RM SME, of Amec Foster Wheeler E&C Services Inc. Dr. Parker and Timothy Kuhl, RM SME, also of Amec Foster Wheeler, have independently confirmed the Mineral Resource estimate and are the Qualified Persons for the estimate, which has an effective date of April 22, 2016.

The Flatreef Mineral Resource, with a strike length of 6.5 kilometres, lies predominantly within a flat-to-gently-dipping portion of the Platreef mineralized belt at relatively shallow depths of approximately 500 metres to 1,350 metres below the surface. The Flatreef Deposit is characterized by its very large vertical thicknesses of high-grade mineralization and a platinum-to-palladium ratio of approximately 1:1, which is significantly higher than other recent PGM discoveries on the Bushveld’s Northern Limb.

The Platreef Indicated Mineral Resources for all mineralized zones are 346 million tonnes at a grade of 3.77 g/t 3PE+gold (1.68 g/t platinum, 1.70 g/t palladium, 0.11 g/t rhodium, 0.28 g/t gold), 0.32% nickel and 0.16% copper at a 2.0 g/t 3PE+gold cut-off. The average thickness of the 2.0 g/t 3PE+gold grade shell used to constrain the T2MZ resources for the indicated area is 19 metres.

Inferred mineral resources for all mineralized zones are 506 million tonnes at a grade of 3.24 g/t 3PE+gold (1.42 g/t platinum, 1.46 g/t palladium, 0.10 g/t rhodium, 0.26 g/t gold), 0.31% nickel and 0.16% copper. The average thickness of the 2.0 g/t 3PE+gold grade shell used to constrain the T2MZ resources for the inferred area is 12.7 metres.

Figure 1. Mineralization at the Platreef Project is open to expansion to the south

and west, beyond the area of the current Indicated Mineral Resources,

shown in green, and the Inferred Mineral Resources, shown in blue.

Health and safety at Platreef

The Platreef Project reached a total of 5,903,038 million hours in terms of the Mines Health and Safety Act and the Occupational Health and Safety Act by the end of June 2016. The project recorded 1,266,480 lost-time-injury-free hours at Platreef up until the end of Q2 2016. The Platreef Project continues to strive toward its workplace objective of an environment that causes zero harm to any employees, contractors, sub-contractors or consultants.

Shaft 1 construction

Shaft 1, with an internal diameter of 7.25 metres, will provide initial access to the ore body and will enable the initial underground capital development to take place while Shaft 2 (the main production shaft) is being developed. Following the successful commissioning and licencing of the stage and kibble winders and ancillary equipment, the permanent sinking phase started in July 2016. The initial sinking rate is 1.8 metres per day and will continue until sufficient clearance between the shaft bottom and the stage has been created. The main sink is planned to commence at a depth of 107 metres below surface and the advance per day is expected to be increased to 2.7 metres. This phase will continue to a depth of 1,025 metres below surface, which is expected to be reached in early 2018.

Work now is complete on the internal substation, which has a capacity of five million volt-amperes (MVA). Construction is underway on the power transmission lines from Eskom, the South African public electricity utility, which are expected to supply the electrical power to be used for shaft sinking. Back-up generators have been installed to ensure sinking operations continue despite any interruptions in power supply.

The new transmission lines from Eskom also are expected to provide power to an adjacent community near the Platreef Project, which will be a major community benefit. Other on-site work includes the construction of the storm-water drains and ponds.

National Road (N11) intersection construction

Construction began in April of the intersection on the National Road (N11) highway to provide safe and convenient access to the Platreef mine site. The work includes adding extra lanes to the existing roadway, exit and entry ramps, storm-water management and resurfacing of the intersection.

Platreef implementing a phased approach to a large, underground, mechanized mine

Ivanhoe plans to develop the Platreef Mine in phases. The initial annual rate of four million tonnes per annum (Mtpa) is designed to establish an operating platform to support future expansions. This is expected to be followed by a potential doubling of production to 8.0 Mtpa; and then a third expansion phase to a steady-state 12 Mtpa which would establish Platreef among the largest platinum-group-metals mines in the world.

Ivanhoe has made good progress on advancing the feasibility study of the first phase, which began in August 2015. The study is being managed by DRA Global, with specialized sub-consultants including Stantec Consulting, Murray & Roberts Cementation, SRK, Golder Associates and Digby Wells Environmental. There are expected to be opportunities to refine and modify the timing and capacities of subsequent phases of production to suit market conditions during the development and commissioning of the first phase.

Metallurgical testwork and processing

Metallurgical testwork has focused on maximizing the recovery of platinum-group metals and base metals, also while producing an acceptably high-grade concentrate grade for sale to third parties. The three main geo-metallurgical units and composites have produced concentrator grades of approximately 85 to 110 g/t 3PE+gold at good PGE recoveries (86% to 88% 3PE+gold).

Comminution and flotation testwork has demonstrated that the optimum grind size of 80% passing 75 micrometres in one stage of milling is sufficient to achieve recoveries referred to above. This simplifies the circuit and should enable Ivanhoe to optimize the capital and operating cost of the concentrator.

The flow sheet for phase one comprises a four-million-tonne-per-year, three-stage crushing circuit, which will feed into two parallel milling-flotation modules, each with a capacity of two million tonnes per year. Flotation is followed by a four-million-tonne-per-year tailings-handling and concentrate-thickening, filtration and storage circuit.

Planned mining methods to incorporate highly productive, mechanized methods

The selected mining areas in the current mine plan occur at depths ranging from approximately 700 metres to 1,200 metres below the surface. The main access to the Flatreef Deposit and ventilation system is expected to be comprised of four vertical shafts. Shaft 2 will host the main personnel transport cage, material and ore-handling systems, while Shafts 1, 3 and 4 will be utilized for ventilation to the underground workings. Shaft 1, now under development, will be used for initial access to the deposit and early underground development.

The planned mining methods are expected to use highly productive, mechanized methods, including long-hole stoping and drift-and-fill mining. Mined-out areas will be backfilled with a paste mixture that utilizes tailings from the process plant and cement. The ore will be hauled from the stopes to a series of ore passes that will connect to a main haulage level at Shaft 2, from where it will be hoisted to surface for processing.

Shaft 2 is being designed to have an internal diameter of 10 metres and capable of hoisting six million tonnes per year. The headgear design for the six-million-tonne-per-year permanent hoisting facility has been completed by South Africa-based Murray & Roberts Cementation. Ivanhoe expects to start Shaft 2 early works in 2017, including civil work for the box cut and hitch foundation.

Bulk water and electricity supply

The Olifants River Water Resource Development Project (ORWRDP) is designed to deliver water to the Eastern and Northern limbs of South Africa’s Bushveld Igneous Complex. The project consists of the new De Hoop Dam, the raised wall of the Flag Boshielo Dam and related pipeline infrastructure that ultimately is expected to deliver water to Pruissen, southeast of the Northern Limb. The Pruissen Pipeline Project is expected to be developed to deliver water onward from Pruissen to the municipalities, communities and mining projects on the Northern Limb. Ivanhoe is a member of the ORWRDP’s Joint Water Forum. The Minister of Water & Sanitation has directed that the Trans-Caledon Tunnel Authority serve as the implementing agent for the outstanding phases of the ORWRDP scheme, which include the Phase 2B pipeline from Flag Boshielo Dam to Mokopane.

Platreef Project’s water requirement for the first phase of development is projected to peak at approximately 10 million litres per day. This requirement is to be serviced by the scheme. Ivanhoe also is investigating various alternative sources of bulk water, including an allocation of bulk grey-water from the local Mogalakwena municipality.

The Platreef Project’s electricity requirement for a four-million-tonne-per-year underground mine, concentrator and associated infrastructure has been estimated at approximately 100 million volt-amperes. An agreement has been reached with Eskom for the supply of phase-one power. Ivanhoe chose a self-build option for permanent power, enabling Ivanhoe to manage the construction of the distribution lines from Eskom’s Burutho sub-station to the Platreef Mine.

Development of human resources and job skills

Work is progressing well on the further implementation of Ivanhoe’s Social and Labour Plan, to which the company has pledged a total of R160 million ($11 million) during the first five years, until November 2019. The approved plan includes R67 million ($4 million) for the development of job skills among local residents and R88 million ($6 million) for local economic development projects. Additional internal training is ongoing to provide members of the current workforce with opportunities to expand their skills.

2. Kipushi Project

68%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kipushi copper-zinc-germanium-lead mine, in the Democratic Republic of Congo, is adjacent to the town of Kipushi and approximately 30 kilometres southwest of Lubumbashi. It also is located on the Central African Copperbelt, approximately 250 kilometres southeast of Ivanhoe’s Kamoa Project, and less than one kilometre from the Zambian border. Ivanhoe acquired its 68% interest in the Kipushi Project in November 2011; the balance of 32% is held by the state-owned mining company, La Générale des Carrières et des Mines (Gécamines).

Health, safety and community development at Kipushi

The Kipushi Project achieved a total of 4,418,232 lost-time-injury-free hours (1,423 days) to the end of Q2 2016. Malaria remains the most frequent health concern at Kipushi; in Q2 2016, there was an average of 12 cases each month among employees, but numbers are declining with the dry season.

In an effort to reduce the incidence of malaria in the Kipushi community, a Water Sanitation and Health (WASH) program has been initiated in cooperation with the Territorial Administrator and the local community. The main emphasis of the program’s first phase is cleaning storm drains in the municipality to prevent the accumulation of ponded water, where malarial mosquitos breed.

The Fionet program to combat malaria rolled out 37 Deki Readers, which provide rapid malaria tests, and provided training of operators at medical service providers in the Kipushi Health Zone. The program is expected to expand to a total of 300 Deki Readers in Q3 2016. Results from the initial six months of the program are strongly encouraging, as unnecessary medication is no longer prescribed to approximately half of all patients, who tested negative for malaria.

National Road rehabilitation through the center of Kipushi municipality was completed by MCK under contract to Ivanhoe. As part of a Haut Katanga provincial initiative, the Office of Roads and Drainage, in conjunction with the work completed by Ivanhoe, is completing the tarmac surface on the road.

Project development and infrastructure

The Kipushi Mine, which had been placed on care and maintenance in 1993, flooded in early 2011 due to a lack of pump maintenance over an extended period. At its peak, water reached 851 metres below the surface. A major milestone was reached in December 2013 when Ivanhoe restored access to the mine’s principal haulage level at 1,150 metres below the surface. Since then, crews have been upgrading underground infrastructure to permanently stabilize the water levels.

Since completion of the drilling program, water levels have been lowered to approximately the 1,245-metre-level in Shaft 5. Engineering work has focused on upgrading of Shaft 5 conveyances and infrastructure, cleaning the shaft bottom to facilitate the installation of new hoist ropes, repairs and upgrades to the hoisting infrastructure and cleaning and stripping of the main pump station at the 1,200-metre-level.

Figure 2. Main pump station in Shaft 5 at 1,200-metre-level with installation of Grifo

centrifugal pump.

Preliminary economic assessment announced for the redevelopment of the Kipushi Project

Ivanhoe announced a positive preliminary economic assessment (PEA) for the redevelopment of the Kipushi Project on May 2, 2016. The PEA was prepared in compliance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects. On May 27, 2016, the NI 43-101 Technical Report on the PEA was filed on www.sedar.com and the company’s website.

Highlights of the PEA, prepared by OreWin Pty. Ltd., of Adelaide, Australia, and the MSA Group (Pty) Ltd, of Johannesburg, South Africa, include:

- After-tax net present value (NPV) at an 8% real discount rate is $533 million.

- After-tax real internal rate of return (IRR) is 30.9%.

- After-tax project payback period is 2.2 years.

- Leveraging existing surface and underground infrastructure significantly lowers the redevelopment capital compared to a greenfield development project, as well as the time required to reinstate production.

- Life-of-mine average planned zinc concentrate production of 530,000 dry tonnes per annum – with a concentrate grade of 53% zinc – is expected to rank Kipushi, once in production, among the world’s major zinc mines.

- Life-of-mine average cash cost of $0.54/lb. of zinc is expected to rank Kipushi, once in production, in the bottom quartile of the cash-cost curve for zinc producers globally.

A pre-feasibility study now is underway that will further refine the optimal development scenario for the existing underground mine at Kipushi.

3. Kamoa Project

47%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kamoa Copper Project, a joint venture between Ivanhoe Mines and Zijin Mining Group Co., Ltd., is a very large, stratiform copper deposit with adjacent prospective exploration areas within the Central African Copperbelt in the Democratic Republic of Congo (DRC), approximately 25 kilometres west of the town of Kolwezi and about 270 kilometres west of Lubumbashi. Ivanhoe sold a 49.5% share interest in Kamoa Holding Limited (Kamoa Holding), the company that presently owns 95% of the Kamoa Project, to Zijin Mining in December 2015 for an aggregate consideration of $412 million. In addition, Ivanhoe sold a 1% share interest in Kamoa Holding to privately-owned Crystal River Global Limited for $8.32 million – which Crystal River will pay through a non-interest-bearing, 10-year promissory note.

A 5%, non-dilutable interest in the Kamoa Project was transferred to the DRC government on September 11, 2012, for no consideration, pursuant to the DRC Mining Code. Ivanhoe also has offered to transfer an additional 15% interest to the DRC government on terms to be negotiated. Constructive and cordial negotiations over the offer are continuing between Ivanhoe Mines, Zijin and senior DRC government officials. Ivanhoe expects a mutually beneficial agreement to be achieved in the near future that will provide long-lasting, positive benefits to the DRC government and the Congolese people.

Subsequent to the sales to Zijin and Crystal River, Ivanhoe owns an effective 47% of the Kamoa Project, which will decrease to an effective 40% should the additional 15% interest be transferred to the DRC government.

Kamoa is the world’s largest, undeveloped, high-gradecopper deposit. On February 23, 2016, an updated Mineral Resource estimate was issued for the Kamoa Project, with an effective date of May 5, 2014. Kamoa’s Indicated Mineral Resources total 752 million tonnes grading 2.67% copper and containing 44.3 billion pounds of copper at a 1% copper cut-off grade and an approximate minimum true thickness of three metres. In addition to the Indicated Resources, the updated estimate included Inferred Mineral Resources of 185 million tonnes grading 2.08% copper and containing 8.5 billion pounds of copper, also at a 1.0% copper cut-off grade and an approximate minimum true thickness of three metres.

Kamoa 2016 pre-feasibility study envisages first phase mine production of three million tonnes per year at a grade of 3.86% copper

The Kamoa 2016 pre-feasibility study (PFS), which focuses on the initial phase of development, was filed on March 30, 2016.

Highlights include:

- Mine production of three million tonnes per annum (Mtpa) at an average grade of 3.86% copper over a 24-year mine life, resulting in annual copper production of approximately 100,000 tonnes.

- Initial capital cost, including contingency, is $1.2 billion, approximately $200 million lower than estimated in the Kamoa 2013 PEA.

- Life-of-mine average mine-site cash cost is $0.75/lb. of copper.

- After-tax NPV at an 8% discount rate of $986 million.

- After-tax IRR of 17.2% and a payback period of 4.6 years.

- High-grade copper concentrate with an average grade of 39.2% copper and very low arsenic levels.

- Improvements to the mining method have the potential to reduce average mine site cash cost during the first phase to $0.61/lb. of copper, and improve the after-tax NPV at an 8% discount rate to $1.182 billion, the IRR to 18.9% and the payback period to 4.3 years.

The Kamoa 2016 PFS identified several areas for further evaluation to optimize the project’s economics, including:

- The use of controlled-convergence room-and-pillar mining, which has been successfully used by KGHM Polska Miedź S.A. at its copper-mining operations in Poland for the past 20 years. Based on detailed analysis by KGHM Cuprum R&D Centre Ltd., this mining method appears to be well suited to the Kamoa Deposit. If implemented, it potentially could provide significant cost savings as there would be no requirement for cemented backfill and ore extraction ratios would increase.

- Increased production up to 4.0 Mtpa from the proposed initial mining area, with only limited adjustments to the ore-handling and ventilation systems, thereby resulting in a more efficient use of capital.

Ivanhoe and Zijin Mining are working together to define the scope of the feasibility study, taking into account the conclusions and recommendations from the PFS, while critical-path development, such as upgrading of the hydro-electrical facilities at Koni and Mwadingusha, continues to progress.

Health and safety at Kamoa

Health and safety remain key priorities for workers and management alike at the Kamoa Project, where an excellent safety record has been achieved. As of June 30, 2016, a total of 5,183,893 hours had been worked without a lost-time injury.

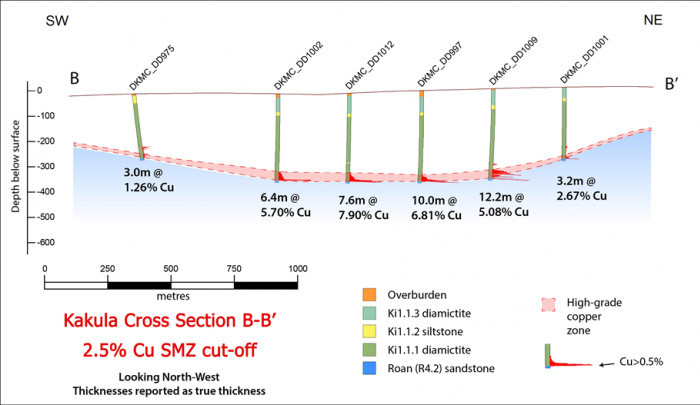

Exploration activities lead to a substantial expansion of the Kakula Discovery

During Q2 2016, the company began its drilling program at the new Kakula Discovery area. The contractor, Titan Drilling Congo SARL, mobilized to the Kakula site on May 17 and seven rigs now are drilling at Kakula, with two rigs on standby. A total of 30 holes were completed during the quarter, with six in progress, resulting in 11,563 metres of diamond drilling.

As a result of the ongoing success of the Kakula program and the extension along trend of the central, well-mineralized, chalcocite-rich core to the northwest and southeast at relatively shallow depths, the Kakula drilling program has been expanded by an additional 9,000 metres, to a total of 34,000 metres of exploration drilling. As the full scale of the discovery becomes apparent, further expansions to the program will be accelerated.

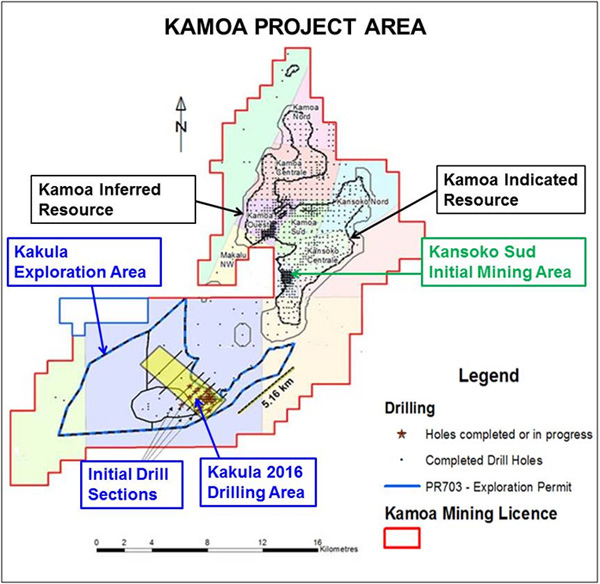

The 60-square-kilometre Kakula exploration area is approximately 10 kilometres southwest of the Kamoa Project’s planned initial mining area at Kansoko Sud, see Figure 3 below. The primary objective of the current drilling program at Kakula is to confirm and expand a thick, flat-lying, bottom-loaded zone of very high-grade, stratabound copper mineralization at the southern part of the Kakula Discovery area that has the potential to be amenable to bulk, mechanized mining and have a significant, positive impact on the Kamoa Project’s future development plans.

Excellent copper recoveries and concentrate grades confirmed by preliminary metallurgical tests of drill core from Kakula Discovery

In July, initial metallurgical test results from a sample of drill core from ongoing exploration in the Kakula Discovery zone achieved copper recoveries of 86% and produced a copper concentrate with an extremely high grade of 53% copper. The results also indicate that material from Kamoa’s Kakula and Kansoko zones could be processed through the same concentrator plant, which would yield significant operational and economic efficiencies.

Testing of the Kakula sample was conducted at Zijin’s laboratory in China, using the flowsheet developed during the Kamoa PFS. The material tested was a composite of drill holes DD996 and DD998, assaying 4.1% copper. As a comparison, testing of a previous development composite sample from the planned, initial mining deposit at Kamoa’s Kansoko Sud zone and the adjacent Kansoko Centrale zone, assaying 3.61% copper, achieved an 85% recovery and a concentrate grade of 37% copper. The PFS circuit was optimized on this material.

Earlier metallurgical testwork indicated that the Kamoa concentrates contain extremely low arsenic levels, by world standards – approximately 0.02%. Given this critical competitive marketing advantage, Kamoa’s concentrates are expected to attract a significant premium from copper-concentrate traders for use in blending with concentrates from other mines. The Kamoa concentrates will help to enable the other concentrates to meet the limit of 0.5% arsenic imposed by Chinese smelters to meet China’s new environmental restrictions.

Expanded drill program at Kakula Discovery

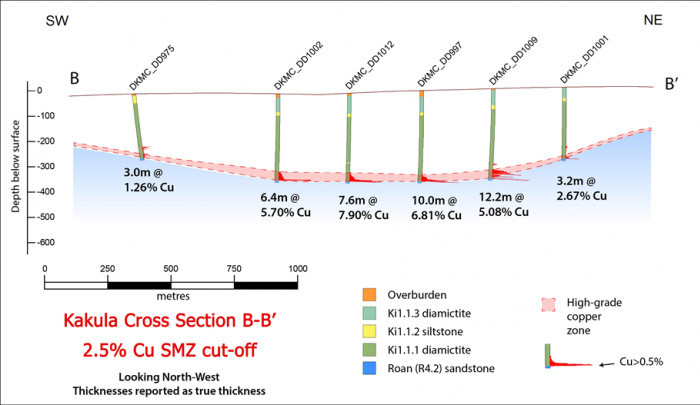

In June 2016, the company provided an update on the Kakula program, which confirmed the exceptional grades and shallow, flat-lying geometry of the Kakula mineralized zone. Highlights include:

- DD998 intersected 11.82 metres (true width) of 4.06% copper at a 2.5% copper cut-off, 11.82 metres (true width) of 4.06% copper at a 2% copper cut-off and 13.79 metres (true width) of 3.68% copper at a 1% copper cut-off.

- DD999 intersected 8.86 metres (true width) of 6.56% copper at a 2.5% copper cut-off, 11.62 metres (true width) of 5.52% copper at a 2% copper cut-off and 13.65 metres (true width) of 4.93% copper at a 1% copper cut-off.

- DD1002 intersected 6.42 metres (true width) of 5.70% copper at a 2.5% copper cut-off, 14.68 metres (true width) of 3.71% copper at a 2% copper cut-off and 32.55 metres (true width) of 2.49% copper at a 1% copper cut-off.

- DD1003 intersected 10.23 metres (true width) of 6.18% copper at a 2.5% copper cut-off, 10.23 metres (true width) of 6.18% copper at a 2% copper cut-off and 18.71 metres (true width) of 3.88% copper at a 1% copper cut-off.

Figure 3. Kamoa Project map shows the planned initial mining area at Kansoko Sud and the nearby Kakula exploration and discovery area.

Additional assays received

Ivanhoe Mines reported highlights of the latest drill results, on August 11, 2016. Significant highlights of these results include:

- DD1005 intersected 7.36 metres (true width) of 8.11% copper at a 2.5% copper cut-off, 10.13 metres (true width) of 6.52% copper at a 2% copper cut-off and 20.71 metres (true width) of 3.85% copper at a 1% copper cut-off.

- DD1011 intersected 6.78 metres (true width) of 7.52% copper at a 2.5% copper cut-off, 11.01 metres (true width) of 5.47% copper at a 2% copper cut-off and 15.20 metres (true width) of 4.40% copper at a 1% copper cut-off.

- DD1012 intersected 7.63 metres (true width) of 7.90% copper at a 2.5% copper cut-off, 13.76 metres (true width) of 5.36% copper at a 2% copper cut-off and 25.17 metres (true width) of 3.59% copper at a 1% copper cut-off.

- DD1017 intersected 10.31 metres (true width) of 6.92% copper at a 2.5% copper cut-off, 10.31 metres (true width) of 6.92% copper at a 2% copper cut-off and 12.35 metres (true width) of 6.04% copper at a 1% copper cut-off.

Table 1. Assay results received in August 2016 from the Kakula Exploration Program.

| 1% Copper cut-off | 2% Copper cut-off | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Drill hole ID | From | To | Length (m) | True Width (m) | Copper Grade (%) | From | To | Length (m) | True Width (m) | Copper Grade (%) | |

| DKMC_DD1004 | Failed to reach target depth | Failed to reach target depth | |||||||||

| DKMC_DD1005 | 369.00 | 391.50 | 22.50 | 20.71 | 3.85 | 379.00 | 390.00 | 11.00 | 10.13 | 6.52 | |

| DKMC_DD1006 | 366.00 | 402.79 | 36.79 | 34.35 | 1.88 | 390.00 | 402.79 | 12.79 | 11.94 | 2.98 | |

| DKMC_DD1007 | 354.00 | 364.20 | 10.20 | 9.52 | 5.37 | 356.70 | 364.20 | 7.50 | 7.00 | 6.91 | |

| DKMC_DD1008 | 325.00 | 338.26 | 13.26 | 13.16 | 5.82 | 325.99 | 338.26 | 12.27 | 12.18 | 6.18 | |

| DKMC_DD1009 | 320.66 | 335.00 | 14.34 | 12.66 | 4.97 | 320.66 | 335.00 | 14.34 | 12.66 | 4.97 | |

| DKMC_DD1010 | Failed to reach target depth | Failed to reach target depth | |||||||||

| DKMC_DD1011 | 412.00 | 427.81 | 15.81 | 15.20 | 4.40 | 416.00 | 427.45 | 11.45 | 11.01 | 5.47 | |

| DKMC_DD1012 | 321.00 | 347.47 | 26.47 | 25.17 | 3.59 | 333.00 | 347.47 | 14.47 | 13.76 | 5.36 | |

| DKMC_DD1013 | Failed to reach target depth | Failed to reach target depth | |||||||||

| DKMC_DD1017 | 349.00 | 361.50 | 12.50 | 12.35 | 6.04 | 349.50 | 359.94 | 10.44 | 10.31 | 6.92 | |

| 2.5% Copper cut-off | 3% Copper cut-off | ||||||||||

| Drill hole ID | From | To | Length (m) | True Width (m) | Copper Grade (%) | From | To | Length (m) | True Width (m) | Copper Grade (%) | |

| DKMC_DD1004 | Failed to reach target depth | Failed to reach target depth | |||||||||

| DKMC_DD1005 | 382.00 | 390.00 | 8.00 | 7.36 | 8.11 | 382.00 | 390.00 | 8.00 | 7.36 | 8.11 | |

| DKMC_DD1006 | 396.00 | 400.30 | 4.30 | 4.01 | 4.27 | 397.00 | 400.30 | 3.30 | 3.08 | 4.79 | |

| DKMC_DD1007 | 356.70 | 363.70 | 7.00 | 6.54 | 7.24 | 358.44 | 363.70 | 5.26 | 4.91 | 8.78 | |

| DKMC_DD1008 | 326.50 | 338.26 | 11.76 | 11.67 | 6.34 | 326.50 | 337.50 | 11.00 | 10.92 | 6.60 | |

| DKMC_DD1009 | 320.66 | 334.50 | 13.84 | 12.22 | 5.08 | 320.66 | 334.50 | 13.84 | 12.22 | 5.08 | |

| DKMC_DD1010 | Failed to reach target depth | Failed to reach target depth | |||||||||

| DKMC_DD1011 | 420.00 | 427.05 | 7.05 | 6.78 | 7.52 | 422.60 | 426.63 | 4.03 | 3.87 | 11.52 | |

| DKMC_DD1012 | 339.45 | 347.47 | 8.02 | 7.63 | 7.90 | 339.45 | 347.47 | 8.02 | 7.63 | 7.90 | |

| DKMC_DD1013 | Failed to reach target depth | Failed to reach target depth | |||||||||

| DKMC_DD1017 | 349.50 | 359.94 | 10.44 | 10.31 | 6.92 | 349.50 | 359.94 | 10.44 | 10.31 | 6.92 | |

Holes DD1011 and DD1017 are of particular importance, representing substantial step outs to the southeast and northwest, respectively. Both holes intersected significant, bottom-loaded, Kakula-style mineralization and have expanded the high-grade core area of the Kakula target to at least two kilometres in length. The full list of additional results is shown in Table 1.

In addition to the eight new holes for which assays were received, as shown in Table 1, Kamoa has completed an additional 28 holes in the Kakula Discovery area that currently are being processed and for which final assays are pending. Holes pending assays and holes currently in progress also are shown in Figure 4. The consistent nature of Kakula mineralization supports the creation of selective, mineralized zones at cut-offs up to 2.5% and 3.0% copper.

Ivanhoe expects to receive an initial, independent Mineral Resource estimate for the Kakula Discovery around the end of Q3 2016. Upon receipt of the resource estimate, the Kamoa technical team plans to begin work on a preliminary economic assessment for Kakula.

Figure 4: Kakula Discovery Area. Drill-hole location plan for the Kakula Area shows holes completed and in progress, superimposed on 1% composite grade thickness contours.

Figure 5. Cross-section A-A’ of Kakula Discovery area, showing true thicknesses of drill intercepts at a 2.5% copper cut-off.

Figure 6. Cross-section B-B’ of Kakula Discovery area, showing true thicknesses of drill intercepts at a 2.5% copper cut-off.

Mine development

Byrnecut Underground Congo SARL (BUCS) completed the first blast at the twin declines on May 12, 2016, marking the beginning of underground mine development. The twin declines, incorporating both a service and a conveyor tunnel, each have advanced more than 130 metres since. Development of the underground mine is designed to reach the high-grade copper mineralization at the Kansoko Sud deposit during the first quarter of 2017. The development is ahead of schedule and within budgeted costs.

Kamoa and contractor teams are working closely and effectively to focus efforts and equipment on the necessary critical activities. The steel sets required for roof support were installed in each decline in June 2016 and ventilation fans were installed recently.

In parallel with the Kamoa 2016 PFS, an alternative mining method – controlled-convergence room-and-pillar mining, developed by Poland-based KGHM – was investigated for its suitability for use on the Kamoa Kansoko deposits. Given the thick, mineralized widths encountered to date in the Kakula drilling program, controlled-convergence room-and-pillar mining also will be investigated for its suitability for use at Kakula.

To help advance the ongoing exploration and delineation of the Kakula deposit, the Kamoa team is proceeding with the engineering and preparation of tender documents for the construction of a box cut at Kakula to accommodate decline ramps that will provide underground access to the deposit.

Four of six mine dewatering boreholes have been completed along the decline and flow testing has commenced. The project team at Kamoa has completed the construction of site offices, a workshop, stores, a vehicle wash-bay, a brake-test ramp and infrastructure for temporary supply of power and water. Upgrading of the contractor camp to meet the rising demand for accommodation is progressing well.

Figure 7. Conveyor decline sets.

Figure 8. Kamoa declines with recently installed ventilation.

Figure 9. Aerial view of Kamoa mine site.

Construction power

A two-megawatt (MW) Sumec generator and a 1.5-MW Caterpillar generator are being rented and provide power for decline development activities until Kamoa receives grid power from the DRC’s state-owned power company, La Société Nationale d’Electricité (SNEL), scheduled in early October 2016 – after which the generators are expected to be used only for back-up power.

Figure 10. Sumec 2-MW generator being commissioned.

A contract has been awarded to a local company for the supply and construction of eight kilometres of 11 kilovolt (kV) overhead lines, cabling reticulation and five mini-substations for distributing 11 kV power to the mine, camps, offices and de-watering boreholes.

The construction of the 120 kV power line, that branches off from the Kisenge Mine to Kamoa and will supply construction power, is 80% completed and expected to be finished in Q3 2016. Construction power is expected to be available to Kamoa from the electrical grid from October 2016 on the commissioning of the 120/11 kV – 15 MVA mobile substation.

Figure 11. 120 kV power line under construction.

Hydroelectric power plant upgrading project

The construction power repair work has progressed well during Q2 2016 and the Mwadingusha Unit 1 was recently completed. Unit 1 is going through the required mechanical and electrical commissioning tests prior to being synchronized to the SNEL national electrical grid, which is expected to occur on August 15, 2016.

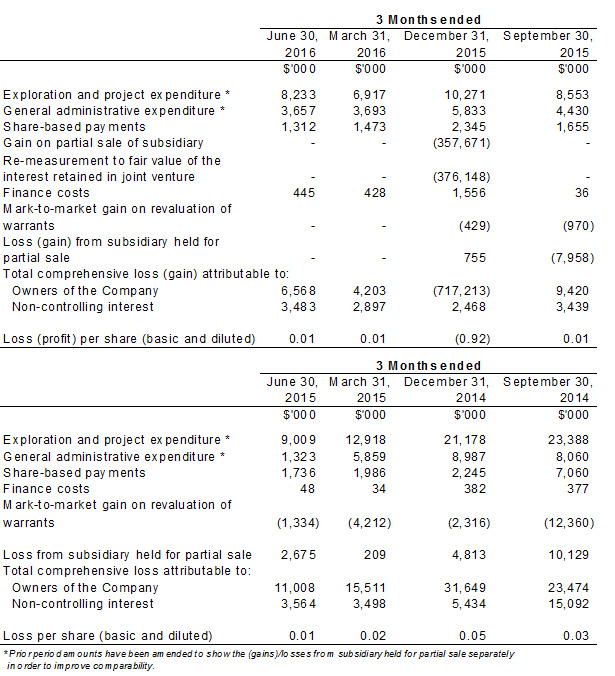

Selected quarterly financial information

The following table summarizes selected financial information for the prior eight quarters. Ivanhoe had no operating revenue in any financial reporting period and did not declare or pay any dividend or distribution in any financial reporting period.

Discussion of results of operations

Review of the three months ended June 30, 2016 vs. June 30, 2015

The company’s total comprehensive loss for Q2 2016 of $10.1 million was $4.5 million lower than for the same period in 2015 ($14.6 million). The decrease mainly was due to a $6.9 million increase in finance income, which included mainly interest earned on loans to the Kamoa joint venture that amounted to $3.8 million and deemed income on the purchase price receivable from the partial sale of the Kamoa Project that amounted to $2.9 million.

Exploration and project expenditures for the three months ending June 30, 2016, amounted to $8.2 million and were $0.8 million less than for the same period in 2015 ($9.0 million).

With the focus at the Platreef Project on development and the Kamoa Project being accounted for as a joint venture, $8.0 million of the total $8.2 million exploration and project expenditure related to the Kipushi Project. Expenditure at the Kipushi Project decreased by $0.8 million compared to the same period in 2015.

Review of the six months ended June 30, 2016 vs. June 30, 2015

The company’s total comprehensive loss of $17.2 million for the six months ended June 30, 2016, was $16.4 million lower than for the same period in 2015 ($33.6 million). The decrease mainly was due to a $15.1 million increase in finance income, together with a $6.8 million decrease in exploration and project expenditure.

Finance income for the six months ending June 30, 2016, amounted to $15.8 million, which was $15.1 million more than for the same period in 2015 ($0.7 million). The increase mainly was due to interest earned on loans to the Kamoa joint venture, which amounted to $7.3 million for the six months ending June 30, 2016, together with deemed finance income on the purchase price receivable from the partial sale of the Kamoa Project, which amounted to $7.2 million.

Exploration and project expenditures for the six months ending June 30, 2016, amounted to $15.2 million and were $6.7 million less than for the same period in 2015 ($21.9 million). The $4.1 million retrenchment costs incurred in 2015 relating to the closure of Ivanhoe’s regional exploration company in the DRC were the main reason for the decrease.

With the focus at the Platreef Project on development and the Kamoa Project being accounted for as a joint venture, $14.7 million of the total $15.2 million exploration and project expenditure related to the Kipushi Project. Expenditure at the Kipushi Project decreased by $2.4 million compared to the same period in 2015.

Financial position as at June 30, 2016 vs. December 31, 2015

The company’s total assets decreased by $20.2 million, from $1,022.6 million as at December 31, 2015, to $1,002.4 million as at June 30, 2016. This mainly was due to the company utilizing its cash resources in its operations.

The remaining purchase price receivable due to the company as a result of the sale of 49.5% of Kamoa Holding decreased as the company received $51.9 million from Zijin during the six months ending June 30, 2016. The present value of the remaining consideration receivable, net of transaction costs, was $149.8 million as at June 30, 2016. Ivanhoe received $41.2 million of the remaining consideration receivable subsequent to June 30, 2016 on July 8, 2016 and the next of the three remaining installments is due on October 24, 2016.

The company’s investment in the Kamoa Holding joint venture increased by $6.5 million from $412.0 as at December 31, 2015, to $418.5 million as at June 30, 2016, with the current shareholders funding the operations equivalent to their proportionate shareholding interest. At Kamoa, the focus remained on development, together with an exploration program at the Kakula Discovery.

Property, plant and equipment increased by $19.1 million, with a total of $21.5 million being spent on project development and to acquire other property, plant and equipment, $19.4 million of which was development costs of the Platreef Project.

The company utilized $16.5 million of its cash resources in its operations and earned interest income of $1.3 million on cash balances in the six months ended June 30, 2016; the company’s portion of the Kamoa joint venture cash calls amounted to $7.7 million.

The company’s total liabilities decreased to $38.2 million as at June 30, 2016, from $43.8 million as at December 31, 2015. This mainly was due to the decrease in trade and other payables of $6.1 million.

Liquidity and capital resources

The company had $294.4 million in cash and cash equivalents as at June 30, 2016. Certain of the company’s cash and cash equivalents, having an aggregate value of $36.9 million, are subject to contractual restrictions as to their use and are reserved for the Platreef Project.

As at June 30, 2016, the company had consolidated working capital of approximately $457.8 million, compared to $424.6 million at December 31, 2015. The Platreef Project working capital is restricted and amounted to $36.2 million at June 30, 2016, and $53.2 million at December 31, 2015. Excluding the Platreef Project working capital, the resultant working capital was $421.6 million at June 30, 2016, and $371.4 million at December 31, 2015. The company believes it has sufficient resources to cover its short-term cash requirements. However, the company’s access to financing always is uncertain and there can be no assurance that additional funding will be available to the company in the near future.

On December 8, 2015, Zijin completed its investment in Ivanhoe’s Kamoa Copper Project. Zijin, through a subsidiary company, has acquired a 49.5% interest in Kamoa Holding for a total of $412 million in a series of payments. Ivanhoe received an initial $206 million from Zijin on December 8, 2015, and a further $41.2 million on each of March 23, 2016, and July 8, 2016; the remaining $123.6 million are scheduled to be received in three equal installments, payable every 3.5 months from the previous installment. Upon closing of the transaction, each shareholder is required to fund Kamoa Holding in an amount equivalent to its proportionate shareholding interest.

The company’s main objectives for 2016 at the Platreef Project remain the continuation of the phase one feasibility study and Shaft 1 construction. At Kipushi, the principal objective is the continued upgrading of mining infrastructure, now that the preliminary economic assessment has been successfully completed. At the Kamoa Project, priorities are the continuation of drilling and the construction of the twin declines at Kamoa. The company expects to spend $27 million on further development at the Platreef Project; $16 million at the Kipushi Project; and $11 million on corporate overheads for the remainder of 2016 – as well as its proportionate funding of the Kamoa Project, expected to be $40 million for the remainder of 2016.

This release should be read in conjunction with Ivanhoe Mines’ unaudited, condensed, consolidated interim financial statements for the three and six months ended June 30, 2016, and Management’s Discussion and Analysis (MD&A) report available at www.ivanhoemines.com and at www.sedar.com.

Qualified Person

Disclosures of a scientific or technical nature in this news release have been reviewed and approved by Stephen Torr, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Torr is not considered independent under NI 43-101 as he is the Vice President, Project Geology and Evaluation. Mr. Torr has verified the technical data disclosed in this release.

Ivanhoe has prepared a current independent, NI 43-101-compliant technical report for each of the Platreef Project, the Kipushi Project and the Kamoa Project, which are available under the company’s SEDAR profile at www.sedar.com. These technical reports include relevant information regarding the effective dates and the assumptions, parameters and methods of the mineral resource estimates on the Platreef Project, the Kipushi Project and the Kamoa Project cited in this release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this release in respect of the Platreef Project, Kipushi Project and Kamoa Project.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

North America: Bob Williamson +1.604.512.4856

South Africa: Jeremy Michaels +27.82.939.4812

Website www.ivanhoemines.com

Forward-looking statements

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws, including without limitation, the timing and results of: (i) statements regarding Shaft 1 providing initial access for early underground development at the Flatreef Deposit and that Shaft 1 will be utilized to fast-track production during the first phase of the project; (ii) statements regarding the sinking of Shaft 1, including at a daily rate of approximately 1.8 metres per day and 2.7 metres per day; statements regarding Shaft 1 reaching the planned, final depth at 1,025 metres below surface in 2018; (iii) statements regarding the timing of the commencement of Shaft 2 development, including early works; (iv) statements regarding the operational and technical capacity of Shaft 1; (v) statements regarding the internal diameter and hoisting capacity of Shaft 2; (vi) statements regarding the company’s plans to develop the Platreef Mine in three phases: an initial annual rate of four million tonnes per annum (Mtpa) to establish an operating platform to support future expansions; followed by a doubling of production to eight Mtpa; and then a third expansion phase to a steady-state 12 Mtpa; (vii) statements regarding the planned underground mining methods of the Platreef Project; (viii) statements regarding peak water use of 10 million litres per day at the Platreef Project and development of the Pruissen Pipeline Project; (ix) statements regarding the Platreef Project’s electricity requirement; (x) statements regarding the de-watering program at the Kipushi Project; (xi) statements regarding the completion of the Kipushi Project Environmental, Social and Health Impact Assessment (ESHIA) baseline study; (xii) statements regarding the declines having been designed to intersect the high-grade copper mineralization in the Kansoko Sud area; (xiii) statements regarding the primary objective of the current drilling program at Kakula is to confirm and expand a thick, flat-lying, bottom-loaded zone of very high-grade copper mineralization at the southern part of the Kakula Discovery area that has the potential to have a significant, positive impact on the Kamoa Project’s future development plans; (xiv) statements regarding the timing, size and objectives of drilling and other exploration programs for 2016 and future periods; (xv) statements regarding the expectation to have an initial independent Mineral Resource estimate prepared for the Kakula Discovery around the end of Q3 2016; (xvi) statements regarding the completion of installation and repair works at the Mwadingusha power plant; (xvii) statements regarding the implementation of Social and Labour Plan at the Platreef Project; (xviii) statements regarding the planned expansion of the Kakula drilling program to 34,000 metres of drilling; and (xix) statements regarding expected further expenditure in 2016 of $27 million for the further development of the Platreef Project; $16 million at the Kipushi Project; and $11 million on corporate overheads for the remainder of 2016 – as well as its proportionate funding of the Kamoa Project, expected to be $40 million for the remainder of 2016.

Such statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of this release.

As well, the results of the pre-feasibility study of the Kamoa Project, the pre-feasibility study of the Platreef Project and the preliminary economic assessment of the Kipushi Project constitute forward-looking information, and include future estimates of internal rates of return, net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, estimates of capital and operating costs and the size and timing of phased development of the projects. Furthermore, with respect to this specific forward-looking information concerning the development of the Kamoa, Platreef and Kipushi Projects, the company has based its assumptions and analysis on certain factors that are inherently uncertain. Uncertainties include: (i) the adequacy of infrastructure; (ii) geological characteristics; (iii) metallurgical characteristics of the mineralization; (iv) the ability to develop adequate processing capacity; (v) the price of copper, nickel, zinc, platinum, palladium, rhodium and gold; (vi) the availability of equipment and facilities necessary to complete development; (vii) the cost of consumables and mining and processing equipment; (viii) unforeseen technological and engineering problems; (ix) accidents or acts of sabotage or terrorism; (x) currency fluctuations; (xi) changes in regulations; (xii) the compliance by joint venture partners with terms of agreements, (xiii) the availability and productivity of skilled labour; (xiv) the regulation of the mining industry by various governmental agencies; and (xiv) political factors.

This release also contains references to estimates of Mineral Resources and Mineral Reserves. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Estimates of Mineral Reserves provide more certainty but still involve similar subjective judgements. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation (including estimated future production from the company’s projects, the anticipated tonnages and grades that will be mined and the estimated level of recovery that will be realized), which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that ultimately may prove to be inaccurate. Mineral Resource or Mineral Reserve estimates may have to be re-estimated based on: (i) fluctuations in copper, nickel, zinc, platinum group elements (PGE), gold or other mineral prices; (ii) results of drilling; (iii) metallurgical testing and other studies; (iv) proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates and/or changes in mine plans; (vi) the possible failure to receive required permits, approvals and licenses; and (vii) changes in law or regulation.

Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, the factors discussed below and under “Risk Factors”, as well as unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this release.

English

English Français

Français 日本語

日本語 中文

中文