Kipushi 2022 feasibility study highlights outstanding economic results from planned rebirth of the historic Kipushi Mine, with two-year development timeline

Kipushi will be the world’s highest-grade major zinc mine, with average grade of 36.4% zinc over the first five years

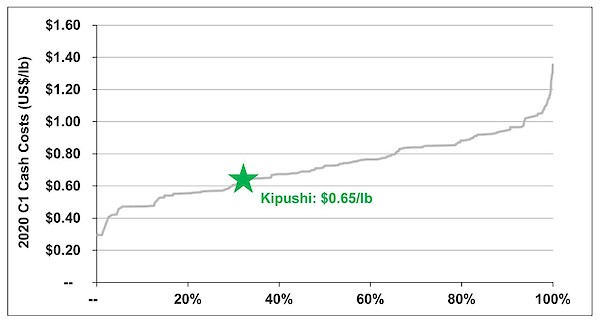

Life-of-mine average annual zinc production of 240,000 tonnes with C1 cash costs of US$0.65/lb of payable zinc

After-tax NPV8% of US$941 million and IRR of 41%, based on long-term zinc price of US$1.20/lb, with pre-production capital cost of US$382 million

After-tax NPV8% of US$2.3 billion and IRR of 73%at current spot zinc price of approximately US$1.67/lb

Kipushi to be fully powered by clean hydroelectricity, aligning with Ivanhoe’s vision to produce “green metals”

Feasibility study based only on zinc-rich resources, including the renowned Big Zinc Zone; significant potential upside from copper-and silver-rich orebodies with future exploration

KIPUSHI, DEMOCRATIC REPUBLIC OF CONGO – Ivanhoe Mines (TSX: IVN; OTCQX: IVPAF) Executive Co-Chair Robert Friedland and President Marna Cloete, together with Alphonse Kaputo Kalubi (Chairman) and Bester-Hilaire Ntambwe Ngoy Kabongo (CEO)of Gécamines, DRC’s state-owned mining company, are pleased to announce that Kipushi Holding, an Ivanhoe Mines wholly-owned subsidiary, and Gécamines have signed a new agreement to return the ultra-high-grade KipushiMine back to commercial production. Kipushi will be the world’s highest-grade major zinc mine, with average grade of 36.4% zinc over the first five years of production.

Watch a new video showcasing Kipushi’s planned transformation into the world’s highest-grade major zinc mine: https://vimeo.com/676846621/282541f745

The new agreement sets out the commercial terms that will form the basis of a new Kipushi joint-venture agreement establishing a robust framework for the mutually beneficial operation of the Kipushi Mine for years to come, and is subject to execution of definitive documentation.

Alphonse Kaputo Kalubi commented: “We recently have witnessed Ivanhoe’s outstanding achievements in transforming the Kamoa-Kakula joint venture into a state-of-the-art copper producer applying the highest standards, now a benchmark on the Congolese Copperbelt. Ivanhoe and Gécamines also have now redefined the Kipushi Project in an equitable manner, aligned with the expectations of the Mining Code and those of Gécamines’ sole shareholder, the Congolese State.

“We are convinced that Kipushi’s new partnership around the Big Zinc will be a benchmark for a successful combination of expertise, resources, a unique asset and a shared desire to create value for stakeholders, the State, shareholders and neighbouring communities. Kipushi, like Kamoa-Kakula, brings new standards, employment opportunities, better health and education infrastructure, and the conditions for the emergence of a dynamic socio-economic fabric around Kipushi. Gécamines, which has operated this mine for a long time, aims, by consolidating its partnership with Ivanhoe, to optimize its contribution to the DRC’s mining sector.”

Bester-Hilaire Ntambwe Ngoy Kabongo added: “We are excited to move our longstanding partnership with Ivanhoe Mines into a new phase that will deliver significant long-term benefits to all parties. Ivanhoe Mines has been a key partner in the Kipushi Project for over a decade and we appreciate their continued commitment to the project. We are confident in Ivanhoe Mines’ technical and financial capabilities to operate the Big Zinc and trust that we can jointly develop the project in a sustainable, responsible and value adding manner for its stakeholders, such as neighbouring communities. Gécamines sees in it the opportunity for an improved exploitation of the Big Zinc, the development of an integrated economic fabric and the imbedding of skills in the Haut-Katanga province.”

“The new agreement with Gécamines is a testament to the great perseverance, ingenuity and patience of Ivanhoe’s team, working alongside our partners in the Democratic Republic of Congo,” Mr. Friedland said. “On behalf of Ivanhoe Mines’ Board, I would like to thank our team, led by our President Marna Cloete, who have helped us arrive at this historic day.

“The outstanding performance by the Kamoa Copper team in delivering the first phases of the Kamoa-Kakula Mine, ahead of schedule and on budget, undoubtedly helped expedite the new agreement, as it showcases our strong development capabilities and industry-leading community initiatives to our partner Gécamines and the Congolese government.

“The new agreement now allows us to responsibly, efficiently and expeditiously develop Kipushi into an ultra-high-grade zinc producer, with outstanding potential to find more zinc, copper, germanium and silver resources – paving the way to fulfilling its promise of significant, long-lasting, economic and social benefits for the Congolese people.

“The past few years have been a significant challenge for us all, including the loyal men and women preparing Kipushi’s underground workings for a resumption of production. Together, we have faced the global impact of the COVID-19 pandemic and we have emerged stronger than ever. Now we have a clear line of sight on having our three tier-one, cornerstone mining assets enter commercial production.”

(L-R) Olivier Binyingo (Ivanhoe Mines Vice President Public Affairs DRC), Marna Cloete (Ivanhoe Mines President), Alphonse Kaputo Kalubi (Chairman of Gécamines), and Louis Watum (General Manager, Kipushi Corporation) discussing the Kipushi partnership during a recent visit to the Kamoa-Kakula mining complex.

Gécamines’ Chairman Alphonse Kaputo Kalubi (left) “operating” a piece of heavy equipment at Kamoa-Kakula’s state-of-the-art training centre.

The re-birth of a mining legend; Kipushi is a significant past producer of copper, zinc, germanium and precious metals

The Kipushi copper-zinc-germanium-silver mine in the DRC Copperbelt is adjacent to the town of Kipushi and approximately 30 kilometres southwest of Lubumbashi. It is located less than one kilometre from the Zambian border.

Kipushi has a long and storied history as a major producer of copper and zinc. Built and then operated by Union Minière for 42 years, Kipushi began mining a reported 18% copper deposit from a surface open pit in 1924. It was the world’s richest copper mine at the time. The Kipushi Mine then transitioned to become Africa’s richest underground copper, zinc and germanium mine. State-owned Gécamines gained control of Kipushi in 1967 and operated the mine until 1993, when it was placed on care and maintenance due to a combination of economic and political factors.

Over a span of 69 years, Kipushi produced a total of 6.6 million tonnes of zinc and 4.0 million tonnes of copper from 60 million tonnes of ore grading 11% zinc and approximately 7% copper. It also produced 278 tonnes of germanium and 12,673 tonnes of lead between 1956 and 1978. There is no formal record of the production of precious metals as the concentrate was shipped to Belgium and the recovery of precious metals remained undisclosed during the colonial era; however, drilling by Ivanhoe Mines has encountered significant silver values within Kipushi’s current zinc- and copper-rich deposits.

Germanium is a strategic metal used today in electronic devices, flat-panel display screens, light-emitting diodes, night vision devices, optical fiber, optical lens systems, and solar power arrays.

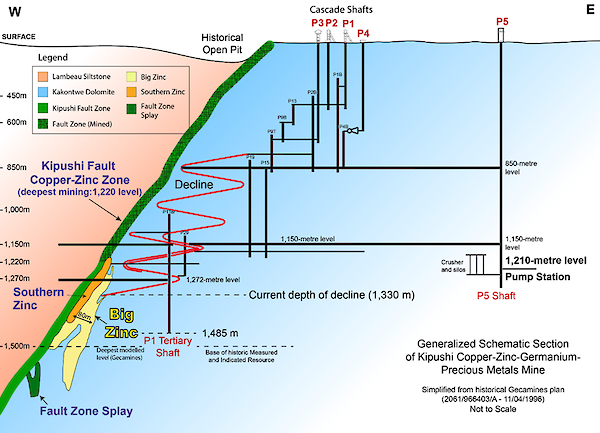

Most of Kipushi’s historical production was from the Fault Zone, a steeply-dipping ore body rich in copper and zinc that initially was mined as an open pit. The Fault Zone extends to a depth of at least 1,800 metres below surface, along the intersection of a fault in carbonaceous dolomites (see Figure 3).

Before Kipushi was idled, Gécamines discovered the Big Zinc deposit at a depth of approximately 1,250 metres below surface and adjacent to the producing Fault Zone (see Figure 3). The Big Zinc Deposit has not been minedand is the initial target for production as outlined in the new feasibility study.

Since acquiring its interest in the Kipushi Mine in 2011, Ivanhoe’s drilling campaigns have upgraded and expanded the mine’s zinc-rich Measured and Indicated Mineral Resources to an estimated 11.78 million tonnes grading 35.34% zinc, 0.80% copper, 23 grams/tonne (g/t) silver and 64 g/t germanium, at a 7% zinc cut-off, containing 9.2 billion pounds of zinc, 8.7 million ounces of silver and 24.4 million ounces of germanium (see Table 1).

In addition, Ivanhoe’s drilling expanded Kipushi’s copper-rich Measured and Indicated Mineral Resources to an additional 2.29 million tonnes at grades of 4.03% copper, 2.85% zinc, 21 g/t silver and 19 g/t germanium, at a 1.5% copper cut-off – containing 144 million pounds of copper (see Table 1).

In 1924, Kipushi began mining 18% copper from a surface open pit, before transitioning to Africa’s richest underground copper and zinc mine. This picture shows the Kipushi open pit in November 1928.

Picture of the headframes for Kipushi shafts 1, 2 and 3, and the Kipushi concentrator in February 1966.

Kipushi’s geology team in 2016 showing a drill intersection in the Big Zinc Deposit of 44.8% zinc over 340 metres, still one of the world’s highest-grade drill holes.

Core from hole KPU008 drilled in 2014 in Kipushi’s Série Récurrente Zone – 11.2 metres of 17% copper and 89.6 g/t silver, highlighting the potential to discover additional zones of copper- and silver-rich mineralization.

Kipushi feasibility study issued, heralding the planned re-start of the historic mine, with a two-year development timeline and exceptional economic results

Ivanhoe Mines today announced the positive findings of an independent, feasibility study for the planned resumption of commercial production at Kipushi.

The Kipushi 2022 Feasibility Study (2022 FS) builds on the results of the pre-feasibility study (PFS) published by Ivanhoe Mines in January 2018. The redevelopment of Kipushi is based on a two-year construction timeline, which utilizes the significant existing surface and underground infrastructure to allow for substantially lower capital costs than comparable development projects. The estimated pre-production capital cost, including contingency, is US$382 million.

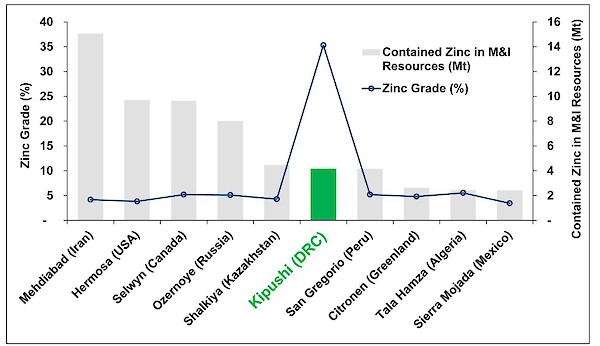

The 2022 FS focuses on the mining of Kipushi’s zinc-rich Big Zinc and Southern Zinc zones, with an estimated 11.8 million tonnes of Measured and Indicated Mineral Resources grading 35.3% zinc. Kipushi’s exceptional zinc grade is more than twice that of the world’s next-highest-grade zinc project, according to Wood Mackenzie, a leading, international industry research and consulting group (see Figure 2).

The 2022 FS does not include any of the copper-rich mineral resources delineated to date and assumes that revenue is attributable to zinc only, with no by-product credits.

The 2022 FS envisages the recommencement of underground mining operations, and the construction of a new concentrator facility on surface with annual processing capacity of 800,000 tonnes of ore, producing on average 240,000 tonnes of zinc contained in concentrate.

Concurrent with the release of the 2022 FS, Ivanhoe is finalizing Kipushi’s development and financing plan, together with its partner Gécamines. The Kipushi Mine is operated by Kipushi Corporation (KICO),a joint venture between Ivanhoe Mines wholly owned subsidiary, Kipushi Holding, and Gécamines, the DRC’s state-owned mining company.

The 2022 FS was independently prepared on a 100%-project basis by OreWin Pty. Ltd., MSA Group (Pty.) Ltd., SRK Consulting (Pty) Ltd. and METC Engineering. A National Instrument 43-101 technical report will be filed on SEDAR at www.sedar.com and on the Ivanhoe Mines website at www.ivanhoemines.com within 45 days of the issuance of this news release.

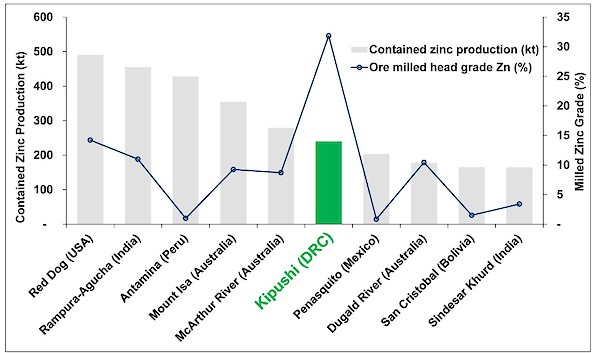

Figure 1: World’s 10 major zinc mines, showing estimated annual zinc production and zinc head grades (ranked by production, 2020).

Source: Wood Mackenzie; January 2022. Note: Wood Mackenzie compared the Kipushi Project’s life-of-mine average annual zinc production and zinc head grade of 240,000 tonnes and 31.9%, respectively, against production and zinc head grades estimated in 2020.

2022 FS re-affirms Kipushi’s outstanding economics

“The feasibility study is the latest validation that Kipushi has the resources to become one of the world’s largest and lowest-cost zinc producers based on the Big Zinc Zone alone.” said Ms. Cloete.

“Discussions are continuing with prospective financing providers to support our advance toward a new era of production at Kipushi. We’ve made major progress in upgrading the mine’s underground infrastructure, and now have a clear path to a resumption of production from this incredibly rich orebody.

“Since acquiring our interest in the Kipushi Mine in 2011, our team has worked hard to prepare the mine for a resumption of commercial operations,” she added. “During that time, we’ve seen zinc prices rally from under US$1.00 to well over US$1.70 per pound. We’re confident that the long-term supply and demand fundamentals would support a strong zinc price for a long time to come.”

Mr. Friedland commented: “We look forward to Kipushi joining the ranks of the world’s largest zinc producers. Zinc, with its key attributes of essentiality, durability, versatility and recyclability, is well positioned as a metal of choice for a modern, sustainable society.

“In addition to being a critical metal in the galvanizing process to protect steel from corrosion, zinc is an essential micronutrient that strengthens the immune system and is crucial for healthy growth and brain development. Zinc also is an essential ingredient for plant life and now is widely used as fertilizer.”

Elvis Mugombe, a member of Kipushi’s dedicated team of employees, is looking forward to a resumption of commercial production.

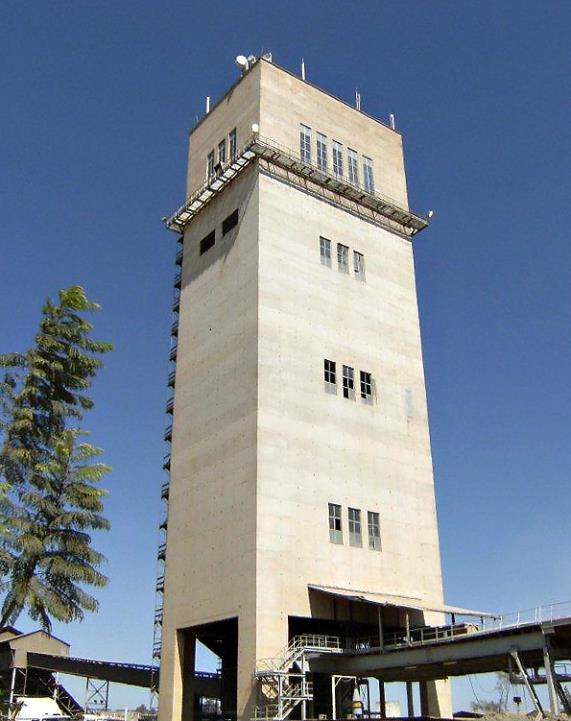

Kipushi’s Shaft 5 headframe. Shaft 5’s main personnel and material winder, as well as the rock hoisting winder, have been upgraded and modernized to meet global industry standards and safety criteria.

Patrick Mwanza Wa Kabongo operating the modern, new hoist at Kipushi’s main production shaft (Shaft 5).

2022 FS HIGHLIGHTS

Summary of 2022 FS results for the Kipushi Mine:

- The 2022 FS evaluates the development of an 800-ktpa underground mine and concentrator, with an increased resource base compared to the PFS, extending the mine life to 14 years.

- Existing surface and underground infrastructure allow for significantly lower capital costs than comparable development projects, with the principal development activity being the construction of a conventional concentrator facility and new supporting infrastructure on surface in a two-year timeline.

- Pre-production capital costs, including contingency, estimated at US$382 million.

- Life-of-mine average zinc production of 240,000 tonnes per annum, with a zinc grade of 32%, is expected to rank Kipushi among the world’s major zinc mines (Figure 1), once in production, with the highest grade by some margin.

- Life-of-mine average C1 cash cost of US$0.65/lb of zinc is expected to rank Kipushi, once in production, in the second quartile of the cash cost curve for zinc producers globally (Figure 11).

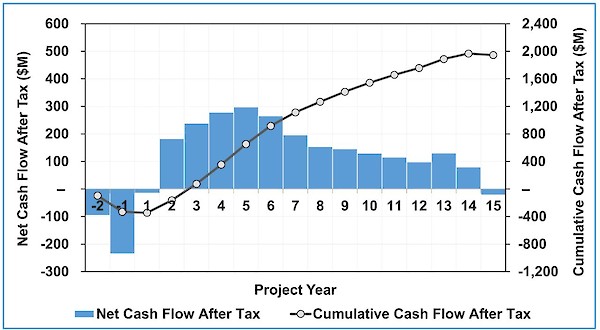

- At a long-term zinc price of US$1.20/lb, the after-tax net present value (NPV) at an 8% real discount rate is US$941 million, with an after-tax real internal rate of return (IRR) of 40.9% and project payback period of 2.3 years.

- At the spot zinc price of approximately US$1.67/lb (February 11, 2022), the after-tax NPV8% increased to US$2,286 million with an after-tax real IRR of 73.5% and project payback period of 1.4 years.

Highlights of the new agreement between Kipushi Holding, Gécamines and KICO:

- Kipushi Holding, 100%-owned by Ivanhoe Mines, will transfer 6% of the share capital and voting rights in KICO to Gécamines, after which Kipushi Holding and Gécamines will hold 62% and 38%, respectively.

- From January 25, 2027, 5% of the share capital and voting rights in KICO shall be transferred from Kipushi Holding to Gécamines, after which Kipushi Holding and Gécamines will hold 57% and 43%, respectively.

- In the event that, after the 6% and 5% transfers, part of KICO’s share capital is required to be transferred to the State or to any third party pursuant to an applicable legal or regulatory provision, Gécamines shall transfer the number of KICO shares required, and Kipushi Holding shall retain 57% ownership in KICO.

- Once a minimum of the current proven and probable reserves and up to 12 million tonnes has been mined and processed, an additional 37% of the share capital and voting rights in KICO shall be transferred from Kipushi Holding to Gécamines, after which Kipushi Holding and Gécamines will hold 20% and 80%, respectively.

- A new supervisory board and executive committee will be established with appropriate shareholder representation.

- New initiatives will be implemented focusing on the development of Congolese employees, including individual development, the identification of future leaders, succession planning and the promotion of gender equality across the workforce.

- A framework for tendering for the offtake of zinc concentrates produced by the Kipushi Mine has been established, which includes Gécamines’ participation.

- Kipushi Holding will continue to fund KICO with the shareholder loan and/or procure financing from third parties for the development of the project. The interest on the shareholder loan will be 6%, which will be applicable from January 1, 2022, on the existing balance and any further advances. Under the terms of the current shareholder loan agreement, the shareholder loan carries interest of LIBOR plus 4%, which is applicable to 80% of the advanced amounts with the remaining 20% interest-free. As of December 31, 2021, the balance of the shareholder loan owing to Kipushi Holding, including accrued interest, was approximately US$528 million.

Kipushi Mineral Resources

The Mineral Resource estimate was prepared in accordance with the 2014 CIM definition standards, incorporated by reference into Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

The estimate was based on the results of the 58 drill holes completed at Kipushi by Ivanhoe Mines in 2017, 84 drill holes completed by Ivanhoe Mines prior to 2016, and an additional 107 historical holes drilled by Gécamines. The Mineral Resource estimate continues to have an effective date from June 2018 and is unchanged as a result of the feasibility study. Mineral Resource estimates were completed below the 1,150-metre-level on the Big Zinc Zone, Southern Zinc Zone, Fault Zone, Fault Zone Splay and Série Récurrente Zone.

The Mineral Resources were categorized either as zinc-rich resources or copper-rich resources, depending on the most abundant metal. The Big Zinc and Southern Zinc zones have been tabulated using zinc cut-off of 7% and are shown in Table 1; the Fault Zone, the Fault Zone Splay and Série Récurrente Zone have been tabulated using copper cut-off of 1.5%, and are shown in Table 2.

For the zinc-rich zones, the Mineral Resource is reported at a base-case cut-off grade of 7.0% zinc and the copper-rich zones at a base-case cut-off grade of 1.5% copper. Given the considerable revenue that could be obtained from the additional metals in each zone, MSA considers that mineralization at these cut-off grades will satisfy reasonable prospects for economic extraction.

Kipushi’s recently-installed underground jaw crusher, which has a crushing capacity of 1,085 tonnes per hour. The crusher was supplied by Sandvik AB, a Swedish multinational engineering company.

Crushed development ore being conveyed from the jaw crusher to the rock hoisting winder at the bottom of Shaft 5.

Kipushi’s main pumping station at the mine’s 1,210-metre level as crews continue to prepare the mine for a resumption of production.

Table 1: Kipushi zinc-rich Mineral Resource at 7% zinc cut-off grade, June 14, 2018

|

Zone |

Category |

Tonnes |

Zn |

Cu |

Pb |

Ag |

Co |

Ge |

|||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Big Zinc | Measured |

3.65 |

39.87 |

0.65 |

0.35 |

18 |

18 |

56 |

|||||

| Indicated |

7.25 |

34.36 |

0.62 |

1.29 |

19 |

12 |

53 |

||||||

| Inferred |

0.98 |

35.32 |

1.18 |

0.09 |

8 |

15 |

62 |

||||||

| Southern Zinc | Indicated |

0.88 |

24.52 |

2.97 |

1.95 |

75 |

6 |

188 |

|||||

| Inferred |

0.16 |

24.37 |

1.64 |

1.20 |

38 |

6 |

61 |

||||||

| Total | Measured |

3.65 |

39.87 |

0.65 |

0.35 |

18 |

18 |

56 |

|||||

| Indicated |

8.13 |

33.30 |

0.87 |

1.36 |

25 |

11 |

68 |

||||||

| Measured & Indicated |

11.78 |

35.34 |

0.80 |

1.05 |

23 |

13 |

64 |

||||||

| Inferred |

1.14 |

33.77 |

1.24 |

0.24 |

12 |

14 |

62 |

||||||

|

Contained metal quantities |

|||||||||||||

|

Zone |

Category |

Tonnes |

Zn |

Cu |

Pb |

Ag |

Co |

Ge (Moz) |

|||||

| Big Zinc | Measured |

3.65 |

3210.6 |

52.3 |

27.8 |

2.06 |

0.14 |

6.60 |

|||||

| Indicated |

7.25 |

5,489.0 |

98.7 |

206.6 |

4.48 |

0.19 |

12.43 |

||||||

| Inferred |

0.98 |

764.0 |

25.5 |

1.9 |

0.26 |

0.03 |

1.96 |

||||||

| Southern Zinc | Indicated |

0.88 |

476.5 |

57.6 |

37.8 |

2.11 |

0.01 |

5.34 |

|||||

| Inferred |

0.16 |

86.7 |

5.8 |

4.3 |

0.20 |

0.00 |

0.32 |

||||||

| Total | Measured |

3.65 |

3,210.6 |

52.3 |

27.8 |

2.06 |

0.14 |

6.60 |

|||||

| Indicated |

8.13 |

5,965.5 |

156.4 |

244.4 |

6.59 |

0.20 |

17.77 |

||||||

| Measured & Indicated |

11.78 |

9,176.0 |

208.6 |

272.2 |

8.65 |

0.34 |

24.36 |

||||||

| Inferred |

1.14 |

850.7 |

31.3 |

6.2 |

0.46 |

0.04 |

2.28 |

||||||

Notes:

- The effective date of the Mineral Resource is June 14, 2018.

- All tabulated data has been rounded and as a result minor computational errors may occur.

- Mineral Resources which are not Mineral Reserves have no demonstrated economic viability.

- The Mineral Resource is reported as the total in-situ Mineral Resource.

- Metal quantities are reported in multiples of Troy Ounces or Avoirdupois Pounds.

- The cut-off grade calculation was based on the following assumptions: zinc price of US$1.0/lb, mining cost of US$50/tonne, processing cost of US$10/tonne, G&A and holding cost of US$10/tonne, transport of 55% zinc concentrate at US$210/tonne, 90% zinc recovery and 85% payable zinc.

Table 2: Kipushi copper-rich Mineral Resource at 1.5% copper cut-off grade, June 14, 2018.

|

Zone |

Category |

Tonnes |

Cu |

Zn |

Pb |

Ag |

Co |

Ge |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fault Zone | Measured |

0.14 |

2.74 |

1.52 |

0.04 |

16 |

77 |

21 |

||||||

| Indicated |

1.22 |

4.11 |

3.32 |

0.09 |

21 |

96 |

30 |

|||||||

| Inferred |

0.20 |

3.11 |

2.58 |

0.07 |

18 |

43 |

23 |

|||||||

| Série Récurrente | Indicated |

0.93 |

4.14 |

2.43 |

0.02 |

23 |

50 |

4 |

||||||

| Inferred |

0.03 |

1.81 |

0.06 |

0.00 |

8 |

52 |

0.3 |

|||||||

| Fault Zone Splay | Inferred |

0.21 |

4.91 |

19.84 |

0.01 |

21 |

107 |

93 |

||||||

| Total | Measured |

0.14 |

2.74 |

1.52 |

0.04 |

16 |

77 |

21 |

||||||

| Indicated |

2.15 |

4.12 |

2.94 |

0.06 |

22 |

76 |

19 |

|||||||

| Measured & Indicated |

2.29 |

4.03 |

2.85 |

0.06 |

21 |

76 |

19 |

|||||||

| Inferred |

0.44 |

3.89 |

10.77 |

0.04 |

19 |

75 |

55 |

|||||||

|

Contained metal quantities |

||||||||||||||

|

Zone |

Category |

Tonnes |

Cu |

Zn |

Pb |

Ag |

Co |

Ge |

||||||

| Fault Zone | Measured |

0.14 |

8.5 |

4.7 |

0.1 |

0.07 |

0.02 |

0.09 |

||||||

| Indicated |

1.22 |

110.8 |

89.7 |

2.5 |

0.82 |

0.26 |

1.19 |

|||||||

| Inferred |

0.20 |

13.4 |

11.1 |

0.3 |

0.12 |

0.02 |

0.14 |

|||||||

| Série Récurrente | Indicated |

0.93 |

84.6 |

49.8 |

0.5 |

0.69 |

0.10 |

0.12 |

||||||

| Inferred |

0.03 |

1.3 |

0.04 |

0.0 |

0.01 |

0.00 |

0.00 |

|||||||

| Fault Zone Splay | Inferred |

0.21 |

23.2 |

93.7 |

0.1 |

0.14 |

0.05 |

0.64 |

||||||

| Total | Measured |

0.14 |

8.5 |

4.7 |

0.1 |

0.07 |

0.02 |

0.09 |

||||||

| Indicated |

2.15 |

195.4 |

139.4 |

3.0 |

1.51 |

0.36 |

1.31 |

|||||||

| Measured & Indicated |

2.29 |

204.0 |

144.2 |

3.1 |

1.58 |

0.39 |

1.40 |

|||||||

| Inferred |

0.44 |

37.9 |

104.9 |

0.4 |

0.27 |

0.07 |

0.78 |

|||||||

Notes:

- The effective date of the Mineral Resource is June 14, 2018.

- All tabulated data has been rounded and as a result minor computational errors may occur.

- Mineral Resources which are not Mineral Reserves have no demonstrated economic viability.

- The Mineral Resource is reported as the total in-situ Mineral Resource.

- Metal quantities are reported in multiples of Troy Ounces or Avoirdupois Pounds.

- The cut-off grade calculation was based on the following assumptions: copper price of US$3.0/lb, mining cost of US$50/tonne, processing cost of US$10/tonne, G&A and holding cost of US$10/tonne, 90% copper recovery and 96% payable copper.

Ivanhoe’s 2017 infill and confirmation drilling in the Southern Zinc Zone confirmed the high tenor of this mineralized zone (tenor is the percentage of minerals that is actual metal to be extracted), which is characterized by high zinc, copper, lead and silver grades.

The polymetallic style of mineralization in the Southern Zinc is very similar to historical Kipushi production, with a clear zonation of copper-rich to zinc-rich zones. Using a zinc cut-off of 7%, the Southern Zinc Zone contains 0.88 million tonnes of Indicated Mineral resources at a grade of 24.5% zinc, 2.97% copper, 1.95% lead and 75 g/t silver. Additional Inferred Mineral resources in this zone are 0.16 million tonnes at a grade of 24.37% zinc, 1.64% copper, 1.2% lead and 38 g/t silver.

Figure 2: World’s top 10 zinc projects, by contained zinc.

Source: Wood Mackenzie, January 2022. Note: All tonnes and metal grades of individual metals used in the equivalency calculation of the above-mentioned projects (except for Kipushi) are based on public disclosure and have been compiled by Wood Mackenzie. All metal grades have been converted by Wood Mackenzie to a zinc equivalent grade at Wood Mackenzie’s respective long-term price assumptions.

Updated Mineral Reserves extend 2022 FS mine life by three years

The Kipushi 2022 Mineral Reserve Statement has been estimated by Qualified Person Bernard Peters, Technical Director – Mining, OreWin Pty Ltd, using the 2014 CIM Definition Standards. The Mineral Reserve is based on the June 14, 2018 Mineral Resource. The effective date of the Mineral Reserve statement is February 14, 2022. The table below shows the total Proved and Probable Mineral Reserves of Kipushi.

Table 3. Kipushi 2022 FS Mineral Reserve Statement

| Category |

Tonnage |

Zinc |

Zinc |

|---|---|---|---|

| Proven Mineral Reserve |

3.33 |

37.4 |

1,246 |

| Probable Mineral Reserve |

7.48 |

29.4 |

2,199 |

| Total Mineral Reserve |

10.81 |

31.9 |

3,445 |

Notes:

- The effective date of the Mineral Reserves is February 14, 2022.

- Net Smelter Return (NSR) is used to define the Mineral Reserve cut offs, therefore cut off is denominated in $/t. By definition, the cut off is the point at which the costs are equal to the NSR. An elevated cut-off grade of US$135/t NSR was used to define the mining shapes. The marginal cut-off grade has been calculated to be US$50/t NSR. The NSR for cut off was calculated using a zinc price of US$1.10/lb zinc and a treatment charge of US$170/t concentrate.

- The Kipushi 2022 FS Mineral Reserve is based on a zinc price of $1.10/lb Zn and a treatment charge of $170/t concentrate, while the economic analysis to demonstrate the Kipushi 2022 FS Mineral Reserve has used a zinc price of US$1.20/lb and a treatment charge of US$190/t concentrate.

- Only Measured Mineral Resources were used to report Proven Mineral Reserves and only Indicated Mineral Resources were used to report Probable Mineral Reserves.

- Mineral Reserves reported above were not additive to the Mineral Resources and are quoted on a 100% project basis.

- The Mineral Reserve is based on the June 14, 2018 Mineral Resource.

- Totals may not match due to rounding.

- The Proven and Probable Reserve estimate has been reported to conform with the CIM Standards on Mineral Resources (CIM, 2005) of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM).

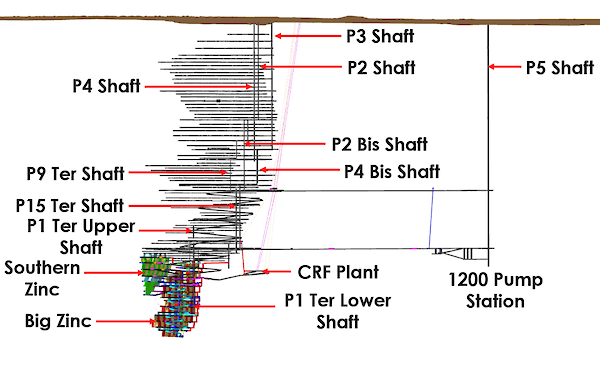

Project development and infrastructure

Significant progress has been made in recent years to modernize the Kipushi Mine’s underground infrastructure in preparation for the resumption of commercial production, including upgrading a series of vertical mine shafts to various depths, with associated headframes, as well as underground mine excavations and infrastructure.

A series of crosscuts and ventilation infrastructure is still in working condition and has been cleared of old materials and equipment to facilitate modern, mechanized mining. The underground infrastructure also includes a series of high-capacity pumps to manage the mine’s water levels, which now are easily maintained at the bottom of the mine.

Shaft 5 is eight metres in diameter and 1,240 metres deep, and has been upgraded and re-commissioned. The main personnel and material winder has been upgraded and modernized to meet international industry standards and safety criteria. The Shaft 5 rock-hoisting winder also is fully operational with new rock skips, new head- and tail-ropes, and attachments installed. The two newly manufactured rock conveyances (skips) and the supporting frames (bridles) have been installed in the shaft to facilitate the hoisting of rock from the main ore and waste storage silos feeding rock on the 1,200-metre level.

Filemon Mulubwa Kasompe inspecting Kipushi’s potable water pumps that provide clean drinking water to residents in local communities.

Figure 3: Schematic section of Kipushi Mine.

Source: Ivanhoe, 2022

Recently upgraded underground mine with easy access to stopes allows for rapid production ramp-up

Mining at Kipushi has historically been carried out from the surface to a depth of approximately 1,220 metres (Figure 4). Shaft 5 (P5) is planned to be the main production shaft with a maximum hoisting capacity of 1.8 million tonnes per annum (Mtpa) and provides the primary access to the lower levels of the mine, including the Big Zinc Zone, through the 1,150-metre haulage level.

Mining will be performed using highly productive mechanized methods and cemented rock fill will be utilized to fill open stopes. Material generated underground will be trucked to the base of the P5 shaft, crushed and hoisted to surface. Personnel and equipment access also are via the P5 shaft. The Big Zinc Zone will be accessed via the existing decline, without significant new development required. As the existing decline already is below the first planned stoping level, it is relatively quick to develop the first zinc stopes for the ramp up of mine production.

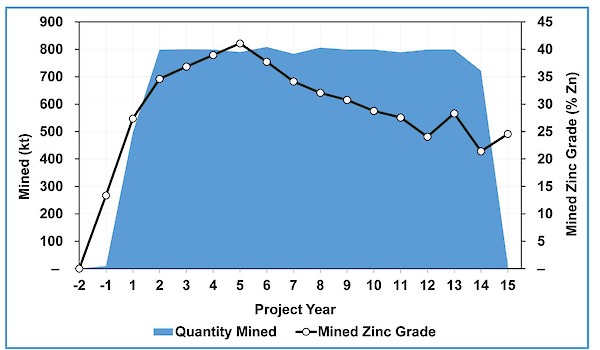

An optimized mine sequence was developed for the 2022 FS in order to mine the highest-grade portion of the Big Zinc orebody earlier, by accelerating mine development during the plant construction period. As a result, the average grade for the first five years of mining increased from 30.2% in the PFS to 36.4% in the 2022 FS.

Figure 4: Planned and existing development at Kipushi.

Source: OreWin, 2022

Optimized processing methodology increases zinc recovery to 96%

Metallurgical testwork conducted during the 2022 FS program demonstrated that the Kipushi flowsheet could be optimized to maximize zinc output by means of a dense media separation (DMS) and mill-float circuit. A bulk sulphide flotation circuit is considered for its simplicity in terms of reagent suite, reagents handling, and cost savings – producing a superior consistent performance when compared to the differential flotation circuit during the PFS phase.

Overall zinc recovery of approximately 96% was achieved at a concentrate grading 54.8% zinc during the 2022 FS, compared to 90% zinc recovery and 59% zinc concentrate grade in the PFS. Relatively low grades of copper and lead from the Big Zinc area provide for bulk sulphide concentrates with low content at 0.6% copper and 0.7% lead that are well within acceptable limits for saleable zinc concentrate specification.

Renette Kalwambisha, one of Kipushi’s team of young Congolese employees from the Kipushi area.

Elvis Mugombe checking electrical readings during hoisting operations.

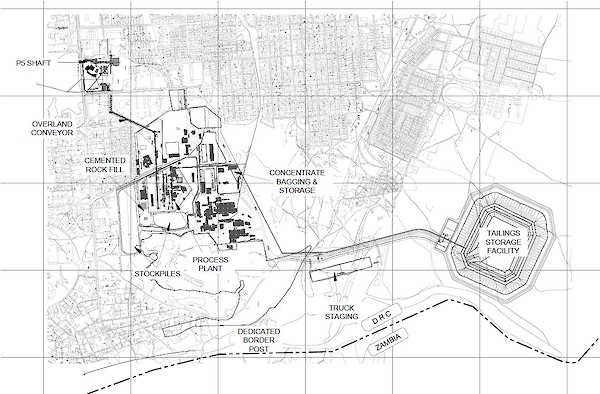

Figure 5: Kipushi Mine’s proposed site layout, showing proximity to the DRC-Zambia border.

Source: Ivanhoe, 2022

Kipushi border post provides logistics advantage

The Kipushi Mine is less than one kilometre from the Zambian border. The 2022 FS is based on transporting concentrate by road from Kipushi to Ndola, Zambia through the Kipushi border post. In June 2019, KICO received approval for a border post dedicated to the mine from the Direction Générale de Migration (DGM), which allows trucks carrying zinc concentrate to mitigate the traffic and standing time of other export routes.

From Ndola, concentrate may be transported directly to port as break bulk concentrate via three export corridors including Durban, Walvis Bay and Dar es Salaam.

Key projections from the Kipushi 2022 FS

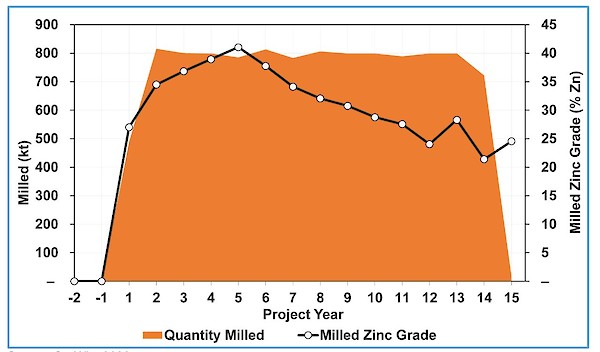

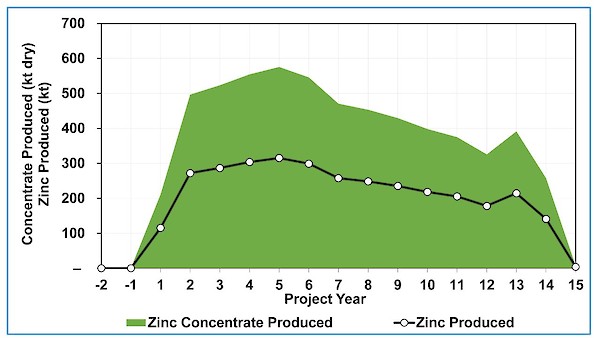

The mine schedule has been designed for a fast ramp up, initially targeting the highest-grade areas of the Big Zinc orebody to meet the annual milling capacity of 800,000 tonnes. The mining production forecasts are shown in Table 4. Mining and processing statistics are shown in figures 6 to 8.

Table 4: Mining production statistics.

| Description |

Unit |

Total LOM |

5-Year Average |

LOM Average |

|---|---|---|---|---|

| Zinc Feed – Tonnes Processed | ||||

| Zinc Ore Treated |

kt |

10,814 |

792 |

787 |

| Zinc Feed Grade |

% |

31.9 |

36.4 |

31.9 |

| Zinc Concentrate Recovery |

% |

95.6 |

95.9 |

95.6 |

| Zinc Concentrate Produced |

kt (dry) |

6,013 |

508 |

437 |

| Zinc Concentrate Grade |

% |

54.8 |

54.8 |

54.8 |

| Contained Zinc in Concentrate |

kt |

3,294 |

278 |

240 |

Figure 6: Estimated tonnes mined and zinc feed grade.

Source: OreWin, 2022

Figure 7: Estimated tonnes processed and zinc feed grade.

Source: OreWin, 2022

Figure 8: Zinc concentrate and contained zinc production.

Source: OreWin, 2022

Economic analysis

The cash flow estimates have been prepared on a real basis as at January 1, 2022, and a mid-year discounting is used to calculate the NPV. All monetary figures expressed are US dollars ($) unless otherwise stated.

The projected financial results for undiscounted and discounted cash flows, at a range of discount rates, IRR and payback are shown in Table 5. The key economic assumptions for the discounted cash flow analyses are shown in Table 6. The results of NPV sensitivity analysis to a range of zinc prices and zinc treatment charges are shown in Table 7. A comparison of the Kipushi 2022 FS key results to the Kipushi 2017 PFS is shown in Table 8. A chart of the cumulative cash flow is shown in Figure 9.

Table 5: Key financial results.

| Description |

Discount Rate |

Long-Term Price (1) |

Spot Price (2) |

|---|---|---|---|

| After Tax Net Present Value (US$M) |

Undiscounted |

1,946 |

4,447 |

|

5.0% |

1,228 |

2,900 |

|

|

8.0% |

941 |

2,286 |

|

|

10.0% |

790 |

1,964 |

|

|

12.0% |

663 |

1,695 |

|

| Internal Rate of Return |

– |

40.9% |

73.5 |

| Payback Period (Years) |

– |

2.3 |

1.4 |

- Long-term zinc price of US$1.20/lb.

- Spot zinc price of US$1.67/lb (February 11, 2022).

Table 6: Kipushi 2022 FS key assumptions.

| Parameter |

Unit |

Economic Analysis Assumption |

|---|---|---|

| Zinc Price |

US$/lb |

1.20 |

| Zinc Treatment Charge |

US$/t concentrate (dry) |

190 |

| Transport Cost |

US$/t concentrate (wet) |

266 |

Table 7: After-tax NPV8% and IRR sensitivity to zinc prices and treatment charges.

| Zinc Treatment Charge (US$/t) |

|

Zinc Price (US$/lb) |

|||||||

|---|---|---|---|---|---|---|---|---|---|

|

0.80 |

1.00 |

1.10 |

1.20 |

1.30 |

1.40 |

1.60 |

1.80 |

2.00 |

|

|

100 |

160 |

702 |

922 |

1,140 |

1,357 |

1,574 |

2,202 |

3,022 |

3,830 |

|

15% |

33% |

40% |

47% |

53% |

59% |

73% |

88% |

101% |

|

|

130 |

67 |

635 |

855 |

1,074 |

1,291 |

1,508 |

2,135 |

2,954 |

3,757 |

|

11% |

31% |

38% |

45% |

51% |

57% |

71% |

86% |

100% |

|

|

160 |

-26 |

567 |

788 |

1,007 |

1,225 |

1,442 |

2,065 |

2,885 |

3,678 |

|

7% |

28% |

36% |

43% |

49% |

55% |

70% |

85% |

98% |

|

|

190 |

-115 |

486 |

722 |

941 |

1,159 |

1,376 |

1,999 |

2,817 |

3,586 |

|

1% |

26% |

34% |

41% |

47% |

54% |

68% |

83% |

97% |

|

|

220 |

-206 |

400 |

654 |

874 |

1,093 |

1,310 |

1,932 |

2,748 |

3,494 |

|

N/A |

23% |

31% |

39% |

45% |

52% |

66% |

82% |

95% |

|

|

250 |

-300 |

307 |

587 |

808 |

1,026 |

1,244 |

1,866 |

2,679 |

3,402 |

|

N/A |

20% |

29% |

37% |

44% |

50% |

65% |

80% |

94% |

|

Table 8: Comparison of results from Kipushi 2022 FS to Kipushi 2017 PFS.

| Item |

Unit |

2017 PFS (1) |

2022 FS (2) |

|---|---|---|---|

| Zinc Ore Processed (Total) |

|

|

|

| Ore Processed |

kt |

8,581 |

10,814 |

| Feed Grade |

% |

32.1 |

31.9 |

| Zinc Ore Processed (LOM Average) |

|

||

| Ore Processed |

kt/yr |

780 |

787 |

| Ore Feed Grade |

% |

32.1 |

31.9 |

| Recovery |

% |

89.6 |

95.6 |

| Concentrate Produced |

kt/yr (dry) |

381 |

437 |

| Concentrate Grade |

% |

58.9 |

54.8 |

| Zinc in Concentrate |

|

|

|

| Zinc Produced (LOM Average) |

Mlb/yr |

495 |

528 |

| Zinc Produced (LOM Average) |

kt/yr |

225 |

240 |

| Peak Zinc Production |

kt/yr |

260 |

315 |

| Key Financial Results |

|

||

| Pre-Production Capital |

US$M |

337 |

382 |

| Mine Site Cash Cost |

US$/lb Payable Zn |

0.16 |

0.18 |

| Transport Costs |

US$/lb Payable Zn |

0.21 |

0.28 |

| Treatment & Refining Charges |

US$/lb Payable Zn |

0.15 |

0.19 |

| C1 Cash Cost |

US$/lb Payable Zn |

0.53 |

0.65 |

| Site Operating Costs |

US$/t milled |

88 |

103 |

| Zinc Price Assumption |

US$/lb |

1.10 |

1.20 |

| After-tax NPV8% (US$M) |

US$M |

683 |

941 |

| After-tax IRR |

% |

35% |

41% |

| Payback Period |

Years |

2.2 |

2.3 |

| Project Life |

Years |

11.0 |

13.8 |

1. Based on a zinc price of US$1.10/lb and zinc treatment charge of US$170/t concentrate.

2. Based on a zinc price of US$1.20/lb and zinc treatment charge of US$190/t concentrate.

Figure 9: Projected annual and cumulative cash flow at long-term zinc price assumptions.

Source: OreWin, 2022.

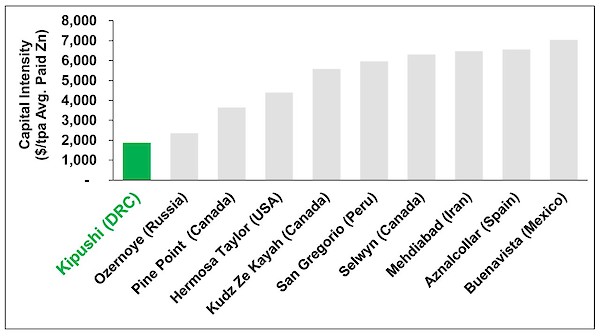

The total capital cost estimates for Kipushi are shown in Table 9. Kipushi’s estimated low capital intensity relative to comparable zinc projects identified by Wood Mackenzie is highlighted in Figure 10.

Table 9: Estimated capital costs.

| Item |

Pre-Production |

Production |

Total |

|---|---|---|---|

|

(US$M) |

(US$M) |

(US$M) |

|

| Underground Mining | |||

| Mining |

154 |

118 |

272 |

| Capitalised Pre-Production Mining |

17 |

– |

17 |

| Subtotal |

171 |

118 |

289 |

| Process & Infrastructure | |||

| Process & Infrastructure |

82 |

41 |

123 |

| Tailings Storage Facility |

7 |

9 |

15 |

| Capitalised Pre-Production Processing |

5 |

– |

5 |

| Subtotal |

94 |

49 |

143 |

| Closure | |||

| Closure |

– |

22 |

22 |

| TSF Closure and Rehabilitation |

– |

3 |

3 |

| Subtotal |

– |

25 |

25 |

| Indirects & Others | |||

| EPCM |

13 |

– |

13 |

| Owners |

47 |

– |

47 |

| Capitalised Pre-Production G&A |

9 |

– |

9 |

| Customs Duties & VAT |

23 |

-34 |

-10 |

| Subtotal |

93 |

-34 |

59 |

| Capital Cost Before Contingency |

357 |

159 |

516 |

| Contingency (10%) |

24 |

– |

24 |

| Capital Cost After Contingency |

382 |

159 |

540 |

Figure 10: Capital intensity for zinc projects.

Source: Wood Mackenzie, January 2022. (based on public disclosure and information gathered in the process of routine research. The Kipushi 2022 FS has not been reviewed by Wood Mackenzie). Note: All comparable “probable”, “possible” and “base case” projects as identified by Wood Mackenzie.

Kipushi’s estimated revenues and operating costs are presented in Table 10, along with the projected net sales revenue value attributable to each key period of operation.

Kipushi’s estimated cash costs are presented in Table 11. Based on data from Wood Mackenzie, life-of-mine average cash cost of US$0.65/lb of zinc is expected to rank Kipushi, once in production, in the second quartile of the 2020 cash cost curve for zinc producers globally (see Figure 11).

Table 10: Estimated operating costs and revenues.

| Description |

Total |

5-Year Average |

LOM |

|---|---|---|---|

|

($/t Milled) |

|||

| Revenue |

|

|

|

| Gross Sales Revenue |

7,408 |

790 |

685 |

| Less Realization Costs | |||

| Transport Costs |

1,757 |

187 |

162 |

| Treatment & Refining Charges |

1,142 |

122 |

106 |

| Royalties |

405 |

43 |

37 |

| Total Realization Costs |

3,305 |

352 |

306 |

| Net Sales Revenue |

4,103 |

438 |

379 |

| Less Site Operating Costs | |||

| Mining |

634 |

61 |

59 |

| Processing |

248 |

23 |

23 |

| Tailings Storage Facility |

9 |

1 |

1 |

| General & Administration |

201 |

20 |

19 |

| Customs Duties – Opex |

19 |

2 |

2 |

| Total |

1,111 |

107 |

103 |

| Operating Margin |

2,992 |

331 |

277 |

| Operating Margin (%) |

40 |

42 |

40 |

Table 11: Estimated cash costs.

| Description |

5-Year Average |

LOM Average |

|---|---|---|

|

(US$/lb Payable Zinc) |

||

| Mine Site Cash Cost |

0.16 |

0.18 |

| Transport Costs |

0.28 |

0.28 |

| Treatment & Refining Charges |

0.19 |

0.19 |

| C1 Cash Cost |

0.63 |

0.65 |

| Royalties & Export Tax |

0.07 |

0.07 |

| Total Cash Costs |

0.70 |

0.72 |

Figure 11: Zinc mine pro-rata C1 cash costs, 2020.

Source: Wood Mackenzie, January 2022 (based on public disclosure and information gathered in the process of routine research. The Kipushi 2022 FS has not been reviewed by Wood Mackenzie).

Note: Represents C1 pro-rata cash costs which reflect the direct cash costs of producing paid metal incorporating mining, processing and offsite realization costs, having made appropriate allowance for the co-product revenue streams.

Crews operating the newly commissioned Shaft 15 winder, part of the underground upgrading work already completed at Kipushi.

Women and children filling up their water containers at one of the community potable water stations installed by the Kipushi team.

Children from communities near the Kipushi Mine gathering near one of the potable water stations. Ivanhoe Mines is committed to developing leading-edge mines that provide responsible access to key metals, such as zinc, that are needed to build a better world for our children and our grandchildren.

Qualified Persons

The following companies have undertaken work in preparation of the Kipushi 2022 FS:

- OreWin – Overall report preparation, mining, Mineral Reserve estimation and economic analysis.

- MSA Group – Resource and geology.

- SRK Consulting – Mine geotechnical recommendations.

- METC Engineering – Plant and surface infrastructure.

The independent Qualified Persons responsible for preparing the Kipushi 2022 FS, on which the technical report will be based, are Bernard Peters (OreWin); William Joughin (SRK Consulting); John Edwards (METC Engineering); and Michael Robertson and Jeremy Witley (MSA Group). Each Qualified Person has reviewed and approved the information in this news release relevant to the portion of the Kipushi 2022 FS for which they are responsible.

Other scientific and technical information in this news release has been reviewed and approved by Stephen Torr, P.Geo., Ivanhoe Mines’ Vice President, Geosciences, a Qualified Person under the terms of NI 43-101. Mr. Torr is not considered independent under NI 43-101 as he is the Vice President, Geosciences of Ivanhoe Mines. Mr. Torr has verified the technical data disclosed in this news release.

Sample preparation, analyses and security

Ivanhoe Mines maintains a comprehensive chain of custody and QA-QC program on assays from its Kipushi Project. Half-sawn core was processed either at its preparation laboratory in Kamoa, DRC, or its exploration preparation laboratory in Kolwezi, DRC. Prepared samples then were shipped to Bureau Veritas Minerals (BVM) Laboratories in Australia for external assay. Industry-standard certified reference materials and blanks were inserted into the sample stream prior to dispatch to BVM. Ivanhoe Mines’ QA-QC program has been set up in consultation with MSA Group (Pty.) Ltd., of Johannesburg.

Information on sample preparation, analyses and security is contained in the Kipushi Project NI 43-101 Technical Report dated January 25, 2018, filed on SEDAR at www.sedar.com and on the Ivanhoe Mines website at www.ivanhoemines.com.

About Ivanhoe Mines

Ivanhoe Mines is a Canadian mining company focused on advancing its three principal projects in Southern Africa: the development of major new, mechanized, underground mines at the Kamoa-Kakula copper discoveries in the Democratic Republic of Congo and at the Platreef palladium-rhodium-platinum-nickel-copper-gold discovery in South Africa; and the extensive redevelopment and upgrading of the historic Kipushi zinc-copper-germanium-silver mine, also in the Democratic Republic of Congo.

Kamoa-Kakula began producing copper concentrates in May 2021 and, through phased expansions, is positioned to become one of the world’s largest copper producers. Kamoa-Kakula is being powered by clean, renewable hydro-generated electricity and is projected to be among the world’s lowest greenhouse gas emitters per unit of metal produced. Ivanhoe Mines has pledged to achieve net-zero operational greenhouse gas emissions (Scope 1 and 2) at the Kamoa-Kakula Copper Mine. Ivanhoe also is exploring for new copper discoveries on its Western Foreland exploration licences in the Democratic Republic of Congo, near the Kamoa-Kakula Project.

Information contacts

Investors: Bill Trenaman +1.604.331.9834 / Media: Matthew Keevil +1.604.558.1034

Forward-looking statements

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of this release.

Such statements include without limitation, the timing and results of: (1) statements regarding a two year development timeline to bring Kipushi to commercial production; (2) statements regarding successful commencement of commercial production would establish Kipushi as the world’s highest-grade major zinc mine with average grade of 36.4% over the first five years of production; (3) statements regarding Kipushi having an after-tax NPV of US$941 million and an IRR of 41% based on a long term zinc price of US$1.20/lb; (4) statements regarding Kipushi having an after-tax NPV of US$2.3 billion and IRR of 73% at the current spot zinc price of approximately US$1.67/lb; (5) statements regarding pre-production capital estimated at US$382 million; (6) statements regarding future mine production including life-of-mine average annual zinc production of 240,000 tonnes with C1 cash costs of US$0.65/lb of payable zinc; (7) statements regarding a mine life of 14 years and an after-tax project payback period of 2.3 years; (8) statements that Shaft 5 is planned to be the main production shaft with a maximum hoisting capacity of 1.8 million tonnes per annum; (9) statements that the Big Zinc is expected to be accessed via the existing decline and without significant new development; (10) statements the with life-of-mine average cash cost of US$0.65/lb of zinc, Kipushi is expected to rank, once in production, in the second quartile of the 20202 cash cost curve for zinc producers globally; (11) statements that from Ndola, the concentrate will be transported directly to port as break bulk concentrate via three export corridors including Durban, Walvis Bay and Dar es Salaam; and (12) statements regarding expected methods of mining and processing.

As well, all of the results of the Kipushi 2022 feasibility study, constitute forward-looking statements or information, and include future estimates of internal rates of return, net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, estimates of capital and operating costs and the size and timing of development of the project. Furthermore, with respect to this specific forward-looking information concerning the development of the Kipushi Project, the company has based its assumptions and analysis on certain factors that are inherently uncertain. Uncertainties include: (1) the adequacy of infrastructure; (2) geological characteristics; (3) metallurgical characteristics of the mineralization; (4) the ability to develop adequate processing capacity; (5) the price of copper; (6) the availability of equipment and facilities necessary to complete development; (7) the cost of consumables and mining and processing equipment; (8) unforeseen technological and engineering problems; (9) accidents or acts of sabotage or terrorism; (10) currency fluctuations; (11) changes in regulations; (12) the compliance by joint venture partners with terms of agreements; (13) the availability and productivity of skilled labour; (14) the regulation of the mining industry by various governmental agencies; (15) the ability to raise sufficient capital to develop such projects; (16) changes in project scope or design; (17) political factors; (18) unforeseen delays or stoppages in shipping and transportation of goods and equipment; and (19) that the new Kipushi joint venture agreement is executed on anticipated timelines.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to, the factors discussed below and under “Risk Factors”, and elsewhere in this release, as well as unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this release.

The company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors set forth below in the “Risk Factors” section in the company’s 2021 Q3 MD&A and its current annual information form.

English

English Français

Français 日本語

日本語 中文

中文