Early implementation of extraordinary COVID-19 prevention measures has allowed development of the flagship Kakula Copper Mine in D.R. Congo to continue uninterrupted; initial production on track for third quarter of 2021

Management and corporate optimization targets company-wide cash savings of up to US$75 million to strengthen the current treasury of approximately US$600 million

Ivanhoe issues first quarter financial results and review of mine construction progress and exploration activities

TORONTO, CANADA ‒ Ivanhoe Mines (TSX: IVN; OTCQX: IVPAF) today announced its financial results for the quarter ended March 31, 2020. Ivanhoe Mines is a Canadian mining company advancing its three mining projects in Southern Africa: the Kamoa-Kakula copper discovery in the Democratic Republic of Congo (DRC); the Platreef palladium-platinum-nickel-copper-gold-rhodium discovery in South Africa; and the extensive upgrading of the historic Kipushi zinc-copper-lead-germanium mine, also in the DRC.

The company also is exploring for new copper discoveries on its wholly-owned Western Foreland exploration licences, adjacent to the Kamoa-Kakula mining licence. All figures are in U.S. dollars unless otherwise stated.

HIGHLIGHTS

- Development of the Kakula Copper Mine, the first of multiple, planned mining areas at the Kamoa-Kakula Project, is making excellent progress. The first underground access drives intersected Kakula’s initial high-grade ore zone (+8% copper) in April. Ivanhoe and its joint-venture partner Zijin Mining are advancing rapidly on construction of the 3.8 million-tonne-per-annum (Mtpa) processing plant and other surface infrastructure. Initial copper concentrate production is scheduled for the third quarter of 2021.

- In parallel with the construction of the Kakula Copper Mine, the independent Kakula definitive feasibility study (DFS) and an updated Integrated Development Plan for the entire Kamoa-Kakula mining complex also remain on schedule for Q3 2020. The Kakula DFS will provide a high level of accuracy for the project economics for Kakula’s initial phase of mine development, as most construction contracts and orders for significant capital items have been placed at fixed prices. The Integrated Development Plan will include details on the planned expansion phases for the entire Kamoa-Kakula mining complex.

- In early March, Ivanhoe in conjunction with its joint-venture partners implemented strict quarantine and lock-down procedures to ensure the well-being of its employees and mitigate the impact of COVID-19 on its operations. The Kamoa-Kakula minesite has been locked down and all key personnel are on site; as a result, mine development at Kamoa-Kakula has continued uninterrupted. Mine development work at the Platreef Project was temporarily suspended in late March in compliance with the country-wide lock down imposed by the South African Government. Operations at Platreef resumed in late April with reduced staffing levels and stringent safety protocols. Mine development operations at Kipushi remain temporarily suspended in order to reduce the risk to the workforce and local communities.

- Also in early March, following the guidelines outlined by the World Health Organization, the company appointed a task team with overall responsibility for COVID-19 response planning. Ivanhoe’s response team is led by Dr. Nicolette Du Plessis, a specialist in Pediatric Infectious Diseases and a Professor at the University of Pretoria, and includes specialist doctors, paramedics, nurses, as well as counsel from several external, world-leading epidemiologists.

- On March 11, 2020, the company announced that it had promoted its Chief Financial Officer, Marna Cloete, to the position of President, in addition to her role as Chief Financial Officer. The company’s new Executive Committee, led by Marna Cloete, President and CFO, includes Dr. Patricia Makhesha, Executive Vice President, Sustainability & Special Projects; Matthieu Bos, Executive Vice President, Africa; Peter Zhou, Executive Vice President, China; and Pierre Joubert, who was recently promoted to Executive Vice President, Technical Services.

- Ivanhoe is in a strong financial position with cash and cash equivalents of $603 million at the end of March 2020 and no significant debt.

- In April, Ivanhoe announced cost-reduction initiatives to generate cash savings of up to $75 million through 2021, including reducing discretionary spending at the company’s projects, lowering general and administrative costs, voluntary salary reduction for senior management, and deferral of certain exploration activities. The savings will be directed towards developing the Kakula Mine to commercial production on schedule and on budget.

- Underground development at the Kakula Copper Mine continues to advance ahead of schedule and more than 14.4 kilometres of underground development now has been completed ─ 4.4 kilometres ahead of plan. The pace of development is expected to continue to accelerate as additional mining crews are mobilized.

- In April, crews at Kakula began mining ore in areas with a grade of greater than 8% copper. This ore is being stockpiled on a dedicated high-grade surface stockpile, which is forecast to contain 105,000 tonnes grading 5.95% copper by the end of May, 2020. Kakula’s medium-grade ore stockpile is forecast to contain an additional 250,000 tonnes at 3.01% copper. The high-grade stockpile is projected to significantly expand in the coming months as the majority of Kakula’s underground development will be in mining zones grading +5% copper.

- Construction of Kakula’s processing plant is progressing well with more than 9,000 cubic metres of concrete poured. Fabrication of structural steel, processing plant components, and the ball mills is underway. Long-lead-time items for the processing plant have started to arrive on site, and the ball mills are scheduled for arrival in mid-2020.

- Refurbishment of six turbines at the Mwadingusha hydro-electric power plant and associated 220-kilovolt infrastructure, to supply the Kakula Mine with clean hydropower, is progressing. Four turbines are expected to be operational by December 2020, and the remaining two in Q1 2021. The refurbished plant is projected to deliver approximately 72 megawatts of power to the national grid.

- On February 5, 2020, an updated independently verified Indicated Mineral Resource increased the combined Kamoa-Kakula Project Indicated Mineral Resource to 423 million tonnes grading 4.68% copper, at a 3% cut-off. The combined Kamoa-Kakula Project Indicated Mineral Resource now stands at 1.4 billion tonnes grading 2.7% copper, at a 1% cut-off.

- The initial Indicated Mineral Resource estimate for the Kamoa North Bonanza Zone includes 1.5 million tonnes grading 10.7% copper, at a 5% cut-off. Drilling in the first quarter continued to target additional resources in the vicinity of the ultra-high-grade Bonanza Zone and the Far North Zone. Given the shallow depth, remarkable thickness and massive copper sulphide mineralization discovered within the Kamoa North Bonanza Zone, Kamoa-Kakula’s engineers are evaluating potential opportunities to accelerate the development of this discovery.

- The controlling east-west striking structure, thought to be responsible for the massive copper sulphide mineralization in the Kamoa North Bonanza Zone, is visible as a lineament on airborne magnetic images and can be traced over a distance of up to 20 kilometres. It trends west onto the adjacent Western Foreland exploration licences that are 100%-owned by Ivanhoe Mines. Ivanhoe now controls more than 2,500 square kilometres of highly-prospective land holdings in the vicinity of the Kamoa-Kakula mining licence.

- Drilling also has confirmed the extension of the Kamoa North high-grade copper structure for at least 800 metres in the Kiala Discovery area, part of Ivanhoe’s 100%-owned Western Foreland licences that adjoin the Kamoa-Kakula mining licence to the north.

- At the Platreef mine development project in South Africa, the project’s first shaft (Shaft 1) has been sunk to a depth of more than 975 metres below surface. Completion of the shaft to a final depth of approximately 1,000 metres is planned for Q3 2020.

- Ivanhoe is investigating a phased development production plan for the Platreef Project. The plan would target significantly lower initial capital, to accelerate first production by using Shaft 1 as the mine’s initial production shaft, followed by expansions to the production rate as outlined in the 2017 definitive feasibility study (DFS). Concurrently, Ivanhoe is updating the Platreef Project’s 2017 DFS to take into account development schedule advancement since 2017 when the DFS was completed, updated costs and refreshed metal prices and foreign exchange assumptions.

- At the end of March 2020, Kamoa-Kakula had reached 2.01 million work hours free of a lost-time injury; Platreef had reached 528,416 work hours free of a lost-time injury; and Kipushi had reached 2.27 million work hours free of a lost-time injury.

COVID-19 Response Initiatives

In early April, Ivanhoe provided further details on the rigorous protective measures it has implemented to protect the health and well-being of its employees, contractors and local communities while ensuring business continuity at the Kamoa-Kakula Project.

In response to government-imposed travel restrictions and emergency protocols introduced worldwide, strict quarantine and lock-down procedures have been implemented at all three of the company’s projects ─ Kamoa-Kakula, Platreef and Kipushi ─ to prevent the corona virus from spreading to the minesites. To date, no COVID-19 cases have been discovered at Ivanhoe’s projects.

At Kamoa-Kakula, the minesite has been locked down and all key personnel are on site. The supply of food and critical equipment continues under strict delivery protocols. At present, more than 3,450 employees and contractors are based at the minesite, which ensures operational continuity and minimizes the impact on the development schedule.

Platreef temporarily suspended its shaft-sinking operations in compliance with the country-wide lock down imposed by the South African Government on March 26th. In late April, mine development operations resumed at Platreef with reduced staffing levels and strict COVID-19 preventative procedures. Mine development operations at Kipushi are temporarily suspended to reduce the risk to the workforce and local communities.

Following the guidelines outlined by the World Health Organization, the company appointed a task team from senior management with overall responsibility for COVID-19 response planning. The team is led by Dr. Nicolette Du Plessis, a specialist in Pediatric Infectious Diseases and a Professor at the University of Pretoria, and includes specialist doctors, paramedics, nurses, as well as counsel from several external, world-leading epidemiologists. Dr. Du Plessis is president of the Southern African Society of Pediatric Infectious Diseases and president-elect of the Federation of Infectious Diseases Societies of Southern Africa.

The task team, together with its Kamoa-Kakula Project medical response team and its medical service provider, Medical Support Solutions of the United Kingdom, has access to some of the best advice from medical experts from around the globe and has implemented key procedures across the business to ensure minimal disruption to operations.

In response to the COVID-19 pandemic, Ivanhoe postpones its annual general meeting of shareholders and the date for sending out the company’s executive compensation disclosure

Due to restrictions on public gatherings enacted by both the Federal and Provincial governments in Canada in response to the COVID-19 pandemic and to help protect the health and well-being of its shareholders, colleagues, communities and other stakeholders, Ivanhoe has made the decision to postpone its annual and special meeting (AGM) of shareholders to a date no later than the end of September 2020.

As the COVID-19 situation evolves and advice from government and medical authorities is updated, Ivanhoe will set the new AGM date and file a notice of meeting and record date on SEDAR (www.sedar.com).

Given the postponement of the company’s AGM, Ivanhoe also intends to postpone the date when it will send shareholders the management information circular for the annual general meeting, which includes the company’s executive compensation disclosure. The company is relying on BC Instrument 51-516 ─ Temporary Exemptions from Certain Requirements to File or Send Securityholder Materials ─ published on May 1, 2020, that is providing public companies with temporary blanket relief from certain filing and delivery requirements related to the sending of materials for annual general meetings.

Once a new AGM date is determined, Ivanhoe will provide shareholders with the same disclosure documents they would normally receive ahead of an annual meeting, including the executive compensation disclosure, in accordance with applicable legislation.

Principal projects and review of activities

1. Kamoa-Kakula Project

39.6%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kamoa-Kakula Project, a joint venture between Ivanhoe Mines and Zijin Mining, has been independently ranked as the world’s fourth largest copper deposit by international mining consultant Wood Mackenzie. The project is approximately 25 kilometres west of the town of Kolwezi and about 270 kilometres west of Lubumbashi.

Ivanhoe sold a 49.5% share interest in Kamoa Holding Limited (Kamoa Holding) to Zijin Mining in December 2015 for an aggregate consideration of $412 million. In addition, Ivanhoe sold a 1% share interest in Kamoa Holding to privately-owned Crystal River for $8.32 million – which Crystal River will pay through a non-interest-bearing, 10-year promissory note. Since the conclusion of the Zijin transaction in December 2015, each shareholder has been required to fund expenditures at the Kamoa-Kakula Project in an amount equivalent to its proportionate shareholding interest in Kamoa Holding.

A 5%, non-dilutable interest in the Kamoa-Kakula Project was transferred to the DRC government on September 11, 2012 for no consideration, pursuant to the 2002 DRC mining code. Following the signing of an agreement with the DRC government in November 2016, in which an additional 15% interest in the Kamoa-Kakula Project was transferred to the DRC government, Ivanhoe and Zijin Mining now each hold an indirect 39.6% interest in the Kamoa-Kakula Project, Crystal River holds an indirect 0.8% interest and the DRC government holds a direct 20% interest. Kamoa Holding holds an 80% interest in the project.

Members of Kamoa-Kakula’s development team at Kakula’s growing high-grade ore stockpile.

(L-R) Magloire Kashiba (Production Manager), Jinha Numbi (Surveyor Assistant), Nadege Muzala (Explosive Master), Joel Maweji (Surveyor), Daniel Jila (Data Clerk), Dorcas Tabitha (JMMC Explosive Master), Amisi Mwanana (Safety Officer), Didier Masengo (Senior Mine Geologist), Haram Kazadi (Ventilation observer), Wivine Mutango (Ventilation Observer Assistant), Reagan Ngandu (Surveyor Assistant) and Pontien Kalala (Mine Overseer).

Health and safety at Kamoa-Kakula

At the end of March 2020, the Kamoa-Kakula Project reached 2,014,404 work hours free of a lost-time injury. A fatality occurred on February 7, 2020 when a contractor’s employee passed away due to fat embolism syndrome following a broken bone incurred in a workplace accident on January 21, 2020. The Kamoa-Kakula Project continues to strive toward its workplace objective of zero harm to all employees and contractors. Since the fatality in February a number of additional safety interventions have been implemented.

As part of the company’s the COVID-19 response initiatives, the Kamoa-Kakula minesite has been locked down and strict isolation procedures have been implemented in the event of higher-risk personnel, or potential COVID-19 cases. Ten intensive care units, each equipped with a ventilator, and 20 high-care units will be available to treat potential patients, in addition to a quarantine facility for up to 60 potential patients. The project has procured abundant critical protective supplies for its minesite medical professionals, including surgical gloves and N95 face masks.

Definitive Feasibility Study nearing completion for the Kakula Mine

An independent definitive feasibility study (DFS) for the Kakula Mine is underway with an expected completion date of Q3 2020. At the same time, Ivanhoe expects to issue an updated preliminary economic assessment (PEA) for the expanded Kamoa-Kakula combined production scenarios, incorporating Kansoko, Kakula West and Kamoa North mining areas. The updated PEA will include the updated Mineral Resource estimate for Kamoa North which includes the initial Mineral Resource estimate for the Kamoa North Bonanza Zone. The updated resource estimate technical report was filed under the company’s SEDAR profile at www.sedar.com on March 27, 2020.

The forthcoming Kakula DFS will incorporate detailed design, engineering and procurement, which is largely complete. A separate DFS for an on-site smelter is underway in parallel, and will be incorporated into the integrated Kamoa-Kakula PEA.

Additional mining crews added at Kakula to increase pre-production ore stockpiles and position the mine to accelerate the second phase of development

An expansion in initial plant capacity from 3.0 Mtpa to 3.8 Mtpa is planned, which requires increasing the underground mining crews in 2020 from 11 to 14 to ensure sufficient mining operations to feed the expanded plant throughput. This would have the benefit of producing a larger surface stockpile of ore prior to the scheduled commissioning of the processing plant, as well as accelerating the mine development schedule, providing the opportunity to bring forward the commencement of the second phase of development at Kakula. The second 3.8 Mtpa plant module will be primarily fed from the Kakula Mine at a planned full production mining rate of 6 Mtpa. Further study work will determine the amount of tonnes to be sourced from the Kansoko Mine, or elsewhere, to maximize the full milling capacity of 7.6 Mtpa. Any plans to accelerate the second module of Kakula’s processing plant would be subject to securing the necessary project-level financing and an independent definitive feasibility study on increased production mining rates from 6 Mtpa to 7.6 Mtpa.

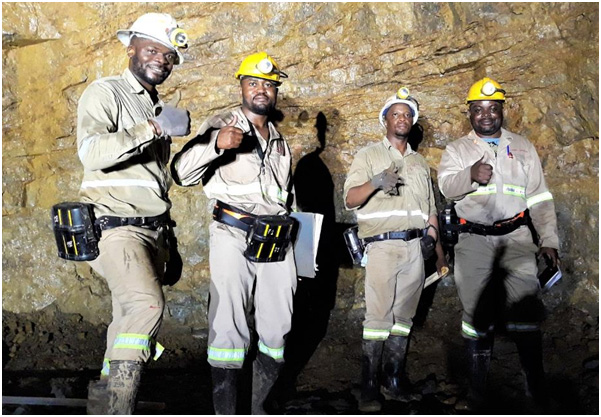

(L-R): Fabrice Nkomba (Mining Overseer), Franck Twite (Senior Geologist), Tebogo Gilbert Jacobs (General Foreman), and Richard Ilunga (Senior Geologist) in one of Kakula’s access drives that currently grades more than 8% copper.

Basic engineering design for the expansion from 3.8 Mtpa to 7.6 Mtpa is currently underway. The scope of facilities includes underground expansion at Kakula, the commencement of mining operations at Kansoko, a second 3.8 Mtpa concentrator module at Kakula as well as associated surface infrastructure to support the expansion at the various sites. The basic engineering is expected to be complete by mid-2020.

In April, crews at Kakula began mining and stockpiling ore with an average grade greater than 8% copper. At the end of May, 2020, Kakula’s high-grade, pre-production ore stockpile is forecast to contain 105,000 tonnes grading 5.95% copper. Kakula’s medium-grade ore stockpile is forecast to contain an additional 250,000 tonnes at 3.01% copper. The high-grade stockpile is projected to significantly expand in the coming months as the majority of Kakula’s underground development will be in mining zones grading +5% copper.

Construction of the concrete foundations for the initial 3.8 Mtpa processing plant’s ball mill foundations is nearing completion.

Construction crews dismantling scaffolding used to construct concrete foundations for the processing plant’s rougher flotation cells.

The current estimate of the project’s initial capital costs is approximately $1.3 billion as of January 1, 2019, which assumes commissioning of the first processing plant module in Q3 2021 and includes expanded plant capacity and pre-production ore stockpiles.

The capital costs incurred by the Kamoa-Kakula joint venture in 2019 amounted to $309.1 million, of which $125.2 million was spent on the Kakula declines and mine development. A further capital cost of $80.9 million has been incurred in Q1 2020.

Ivanhoe will fund its share of approximately 40% of the initial capital costs, plus its share of capital associated with the 20% carried interest owned by the Government of the DRC, which will be repaid through future cash flows from the project. Ivanhoe expects that it will continue to have sufficient cash resources or financing options available to cover its share of the initial capital costs.

Kamoa-Kakula Mineral Resources increased again

Ivanhoe announced the completion of an independently-verified, updated Mineral Resource estimate for the Kamoa-Kakula Project on February 5, 2020. The new Mineral Resource estimate is the culmination of an infill drilling program designed to better define higher-grade copper zones within the existing Kamoa Deposit.

At a 1% cut-off, Kamoa’s Indicated Mineral Resources now total 760 million tonnes grading 2.73% copper, containing 45.8 billion pounds of copper. At the same 1% cut-off, Kamoa’s Inferred Mineral Resources now total 235 million tonnes grading 1.70% copper, containing 8.8 billion pounds of copper. At a 3% cut-off, the new Mineral Resource estimate boosts the Kamoa Deposit’s Indicated Mineral Resource tonnages by 15% and contained copper by 15.5%, to a total of 256 million tonnes at a grade of 4.15% copper. At the same 3% cut-off, Kamoa’s Inferred Mineral Resources now total 13 million tonnes at a grade of 3.51% copper.

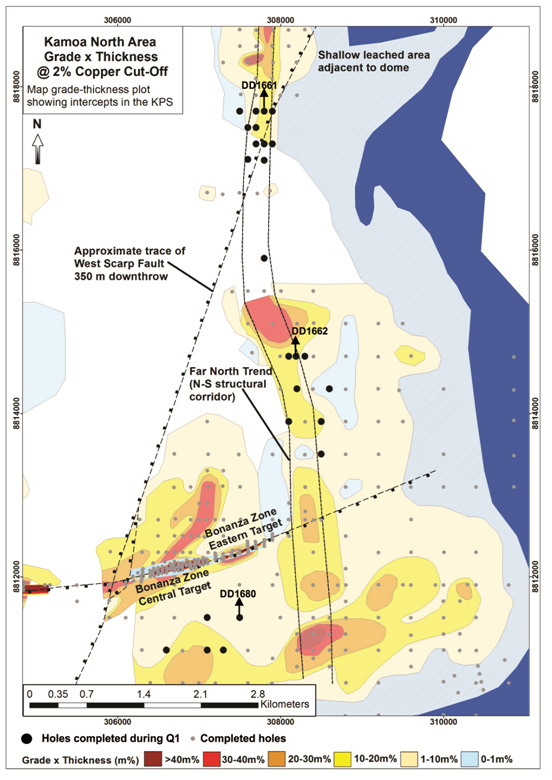

The entire Kamoa Deposit was updated in the new Mineral Resource estimate. The majority of recent drilling, however, targeted the ultra-high-grade Bonanza Zone at Kamoa North, and an approximated north-south corridor of elevated copper grades in the far north of the mining licence area (the Far North Zone).

The new Kamoa Mineral Resource estimate covers approximately 600 metres of strike length in the deeper western portions of the Bonanza Zone (west of the West Scarp Fault), and 1,500 metres of strike length in the shallower eastern portions of the Bonanza Zone; defined by drill sections spaced 50 metres apart on strike in the central section, and 100 metres apart on strike elsewhere.

At a 1% cut-off, the current, combined Indicated Mineral Resources for the Kamoa-Kakula Project now totals 1.387 billion tonnes grading 2.74% copper, containing 83.7 billion pounds of copper. At the same 1% cut-off, Kamoa-Kakula’s combined Inferred Mineral Resources now total 339 million tonnes grading 1.68% copper, containing 12.5 billion pounds of copper.

At a higher 3% cut-off, the current, combined Indicated Mineral Resources for the Kamoa-Kakula Project now totals 423 million tonnes grading 4.68% copper, containing 43.7 billion pounds of copper. At the same 3% cut-off, Kamoa-Kakula’s combined Inferred Mineral Resources now total 17 million tonnes grading 3.51% copper, containing 1.3 billion pounds of copper.

The new Kamoa Indicated and Inferred Mineral Resource estimate was prepared by George Gilchrist, Ivanhoe Mines’ Vice President, Resources, under the direction of Gordon Seibel, RM SME, of the Wood Group (formerly Amec Foster Wheeler E&C Services Inc.) of Reno, USA, and is reported in accordance with the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves. Mr. Seibel is the Qualified Person for the estimate. The effective date of the estimate is January 30, 2020, and the cut-off date for drill data is January 20, 2020. There has been no change to the Mineral Reserve estimate at Kamoa-Kakula.

More than 14.4 kilometres of underground development now completed as the project tracks towards first production in Q3 2021

A total of 11.8 kilometres of underground development was completed by the end of Q1 2020, which was 3.4 kilometres ahead of plan. A record of 1.7 kilometres advancement was achieved at Kakula in April. As of May 8, more than 14.4 kilometres of underground development had been completed ─ approximately 4.4 kilometres ahead of plan.

Mine access drives 1 and 2 (interconnected, parallel tunnels that will provide access to ore zones) continue to progress well towards the southern portion of the orebody. Development also is well advanced on the eastern perimeter drives and the room-and-pillar mining area.

Development from the southern portal has reached south access drives 1 and 2, with mining crews working to establish the connection of these drives with mine access drives 1 and 2 from the north side of the orebody, which is scheduled to occur in September 2020.

A second owner crew was added in March bringing the total number of underground mining crews to nine. The project will continue to add additional crews over the next 12 months to further accelerate development. One training crew is currently operating at the Kansoko mine.

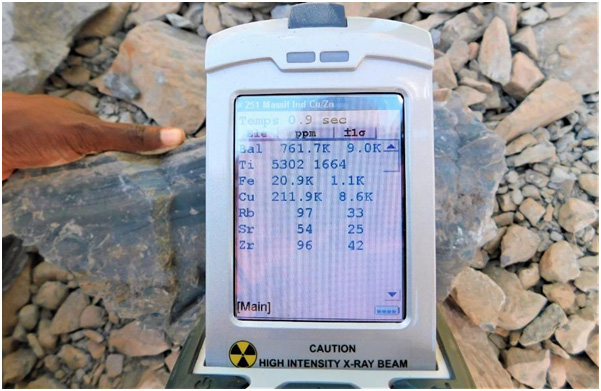

A sample of Kakula’s predominant type of ore ─ fine-grained, gray-coloured chalcocite. This sample grades 211.9 thousand parts per million copper, or 21.19% (Cu). Chalcocite (Cu2S) is nearly 80% copper by weight.

Flory Wavumba Ilunga (Drill Rig Operator) drilling rock-bolt holes into the ceiling of the new water dam being constructed at Kakula’s room-and-pillar mining area. Anchor bolts will be inserted into the holes as an additional safety measure to reinforce the excavated tunnel.

Engineering, procurement and construction advancing well

Project engineering and procurement activities are advancing well. The current primary construction focus that runs through the project’s critical path is the installation of the underground rock handling system, the processing plant and the electrical high-voltage infrastructure installation.

Construction of the underground rock handling system is almost complete, with certain commissioning activities underway. There have been some commissioning delays associated with the site lockdown due to the COVID-19 pandemic. This has affected delivery of commissioning equipment and the deployment of commissioning engineers. The revised date for the first ore delivered to surface on the conveyor system is June 2020.

The reaming of Ventilation Shaft 2 recently was finished in March 2020, bringing the number of 5.5-metre-diameter ventilation shafts completed at Kakula to three (Ventilation Shafts 1 & 2, and Ventilation Shaft North West). The raise bore machine has been moved to Ventilation Shaft North East to start drilling a pilot hole. Ventilation Shaft 1 was fully commissioned with high-capacity fans installed in 2019, while Ventilation Shaft North West and Ventilation Shaft 2 are expected to be commissioned later this year. Ventilation Shaft North East is scheduled to be commissioned in March 2021.

Civil construction of the process plant is in progress with over 9,000 cubic metres of concrete poured and numerous work areas under construction. Fabrication of the ball mills is underway at CITIC Heavy Industries’ factory in Luoyang, China. The process plant long lead items have started to arrive on site, with the ball mills scheduled to arrive in mid-2020.

Construction of the new 220-kilovolt overhead power line, as well as the new electrical switching substation is underway and the switchgear has been ordered.

Construction of the new road linking Kamoa-Kakula with the Kolwezi airport is complete, as well as the new road connecting the Kamoa camp to the Kakula mine. The contractor has now started construction of the new sand haulage road which will connect the sand pit to the backfill plant.

All accommodation at the Kakula village has been completed and is occupied. Construction of the kitchen, mess area and laundry is well advanced.

Cutting Kakula’s ball mill girth gear at CITIC Heavy Industries’ factory in Luoyang, China.

Machining of the ball mill shell at CITIC Heavy Industries’ factory.

Exploration success leads to discovery of shallow, thick, ultra-high grade Kamoa North Bonanza Zone

Drilling activities in Q1 2020 were focused on further definition of known high grade trends in the typical mineralized horizon (Ki1.1.1) at Kamoa North. No further drilling has been done in the Bonanza Zone.

During Q1 2020, 25 holes totalling 5,195 metres were drilled in Kamoa North. Eighteen diamond drill holes were completed in the north-south high-grade trend with X-Ray Florescence (XRF) testwork suggesting several holes with good intersections of copper mineralization. Five drill holes were completed south of the Bonanza Zone to test the typical mineralized horizon. These holes were drilled below a proposed Kamoa North decline tunnel to target the central high-grade portion of the Bonanza Zone. Visual indications within these areas suggested positive results and will require further studies on viable box-cut locations.

The Induced Polarization (IP) survey planned in the Bonanza Zone has been affected by travel restrictions imposed as a response to the COVID-19 pandemic. A decision to conduct this survey will be reviewed in the future.

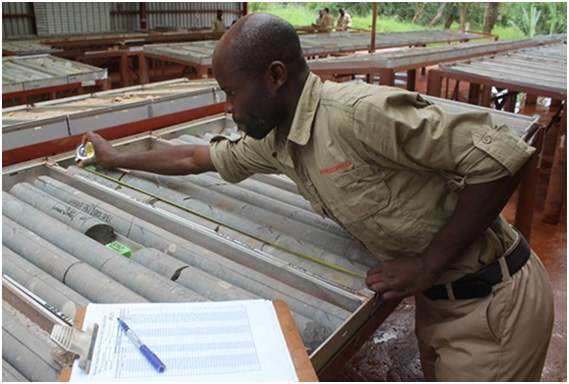

Mike Mwamba (Geology Technician) logging drill core from Kamoa North. On February 6, 2020, Ivanhoe announced that the Indicated Mineral Resource for the Kamoa North Bonanza Zone includes 1.5 million tonnes grading 10.7% copper, at a 5% copper cut-off.

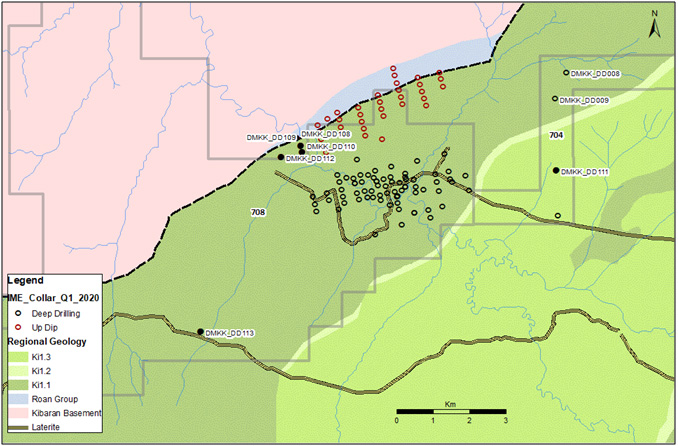

Map of Kamoa North showing the location of holes completed during Q1 2020 (black dots) and holes completed before 2020 (gray dots).

Development options at Kamoa North being considered

All geotechnical and hydrogeological drilling to provide support for future mining studies has been completed and a final resource model has been prepared. Metallurgical flotation test work has yielded positive results in line with expected performance.

A number of different mine development scenarios and mining methods are being reviewed and optimized.

Ongoing upgrading work enables Mwadingusha hydropower station to supply clean electricity to the national grid

Ongoing upgrading work at the Mwadingusha hydropower plant in the DRC has significantly progressed with major equipment being delivered to site. The power station was shut down to replace sections of penstocks that were found to be in an advanced stage of corrosion. The turbines will be fully refurbished and modernized with state-of-the-art control and instrumentation. The progressive re-commissioning of the turbines is underway with four turbines expected to be in operation by December 2020 and the two remaining turbines in Q1 2021. The refurbished plant is projected to deliver approximately 72 MW of power to the national grid.

The work at Mwadingusha is being conducted by engineering firm STUCKY of Lausanne, Switzerland, under the direction of Ivanhoe Mines and Zijin Mining, in conjunction with the DRC’s state-owned power company, La Société Nationale d’Electricité (SNEL SA).

The Kansoko Mine, Kakula Mine and Kamoa camp have been connected to the national hydroelectric power grid since the completion of a 20-kilometre long, 120-kilovolt, single-circuit power line between Kansoko and SNEL SA’s high voltage national grid in September 2016. A 12-kilometres long, 120-kilovolts, dual-circuit power line between Kansoko and Kakula was completed in December 2017. The design of permanent, 11-kilovolt reticulation to the ventilation shafts and mine has started, which includes substations, overhead lines and surface cables.

Aerial view of the Mwadingusha hydropower plant that Ivanhoe and Zijin are upgrading in a private-public partnership venture with the DRC’s state-owned power company, La Société Nationale d’Electricité, to provide long-term, environmentally-friendly electricity for the Kamoa-Kakula Project and the Congolese people.

Assembling one of the alternator cooling systems at the Mwadingusha hydropower plant. The upgrading program is restoring the plant to its installed output capacity of approximately 72 megawatts of clean, sustainable electricity.

Continued focus on enriching communities through sustainable development

The Kamoa-Kakula Sustainable Livelihoods Program is committed to sustainable development in the communities within the project’s footprint. The main objective of the livelihoods program is to enhance food security and living standards of the people who reside within the project area. The program consists primarily of fish farming, poultry production, beekeeping and food crops, including farming of maize (corn), vegetables and bananas. With the increase in development activities at the project, a significant number of employment opportunities have also been made available to residents of the local communities.

The Sustainable Livelihoods Program started in 2010 in an effort to strengthen food security and farming capacity in the host communities near Kamoa-Kakula by establishing an agricultural training garden and support for farmers at the community level. Today, approximately 350 community farmers are benefiting from the Sustainable Livelihoods Program, producing high-quality food for their families and selling the surplus for additional income.

Additional non-farming related activities for Q1 2020 included education and literacy programs, the continuation of a community brick-making program and the supply of fresh water to a number of local communities using solar powered boreholes.

Construction of resettlement houses for the second phase of the relocation program is underway. The survey for the final phase of relocation has been completed and crop compensation will commence shortly, with only five permanent structures being identified. The entire Kakula mine area, including the tailings dam area, will be secured once these relocation phases are complete.

Matemba Mulemba Mamy, a member of the Community Banana Cooperative, picks bananas from a farm near the Kamoa-Kakula Project, part of the Kamoa-Kakula Sustainable Livelihood Program.

2. Platreef Project

64%-owned by Ivanhoe Mines

South Africa

The Platreef Project is owned by Ivanplats (Pty) Ltd (Ivanplats), which is 64%-owned by Ivanhoe Mines. A 26% interest is held by Ivanplats’ historically-disadvantaged, broad-based, black economic empowerment (B-BBEE) partners, which include 20 local host communities with approximately 150,000 people, project employees and local entrepreneurs. In Q2 2019, Ivanplats reached Level 2 contributor status in its verification assessment on the B-BBEE scorecard. A Japanese consortium of ITOCHU Corporation, Japan Oil, Gas and Metals National Corporation; and Japan Gas Corporation, owns a 10% interest in Ivanplats, which it acquired in two tranches for a total investment of $290 million.

The Platreef Project hosts an underground deposit of thick, platinum-group metals, nickel, copper and gold mineralization on the Northern Limb of the Bushveld Igneous Complex in Limpopo Province ─ approximately 280 kilometres northeast of Johannesburg and eight kilometres from the town of Mokopane.

On the Northern Limb, platinum-group metals mineralization is hosted primarily within the Platreef, a mineralized sequence that is traced more than 30 kilometres along strike. Ivanhoe’s Platreef Project, within the Platreef’s southern sector, is comprised of two contiguous properties: Turfspruit and Macalacaskop. Turfspruit, the northernmost property, is contiguous with, and along strike from, Anglo Platinum’s Mogalakwena group of mining operations and properties.

Since 2007, Ivanhoe has focused its exploration and development activities on defining and advancing the down-dip extension of its original discovery at Platreef, now known as the Flatreef Deposit, which is amenable to highly-mechanized, underground mining methods. The Flatreef area lies entirely on the Turfspruit and Macalacaskop properties, which form part of the company’s mining right.

As part of the company-wide cost-cutting measures announced on April 27, 2020, Ivanhoe’s board of directors allocated a reduced total budget for 2020 of $41.7 million for the Platreef Project, of which $31.4 million remains for balance of the year. The sinking of Platreef’s Shaft 1 will continue and be completed to facilitate a relatively quick transition to production.

Health and safety at Platreef

At the end of Q1 2020, the Platreef Project reached a total of 528,416 lost-time, injury-free hours worked in accordance with South Africa’s Mine Health and Safety Act, and Occupational Health and Safety Act. It has been more than four months since the last lost-time injury occurred at the Platreef Project.

In response to the country-wide lock down imposed by the South African Government due to the COVID-19 pandemic, Platreef temporarily suspended its shaft-sinking operations from March 26, 2020. During the suspension, the project kept a small workforce to keep the operation ready for when development resumed. Since April 21, 2020, following the announcement of amended regulations authorizing South African mines to operate at a workforce capacity of 50%, site activities have steadily increased with shaft sinking having resumed under strict mitigation controls.

All employees undergo intensive screening and testing and a full medical evaluation prior to returning to work, which includes a safety refresher and COVID-19 training. Quarantine facilities have been set up in close proximity to the site should there be positive infection cases.

Private transport has been arranged to collect employees from their homes and temperature screening is conducted prior to transport to work. Social distancing, face masks and sanitizing requirements are additional measures implemented during work-related transport. All employees entering the site are subject to temperature screening and the use of appropriate face masks are mandatory. Various other infection control measures have been implemented at the mine site to mitigate the COVID-19 risk.

Platreef phased development plan and update of DFS

Ivanhoe is investigating a phased development plan for the Platreef Project, targeting significantly lower initial capital, to accelerate first production by using Shaft 1 as the mine’s initial production shaft. This plan will focus on initially targeting the development of mining zones accessible from Shaft 1 and maximizing the hoisting capacity of this shaft, followed by expansions to the production rate as outlined in the DFS.

Concurrently, Ivanhoe is updating the Platreef Project’s DFS to take into account development schedule advancement since 2017 when the DFS was completed, updated costs and refreshed metal prices and foreign exchange assumptions. This update, together with the study on the phased development plan, is scheduled for completion in Q3 2020.

Roelof van Wyk (Fitter) records details from his daily inspections in the Winder Control Room for Platreef’s Shaft 1.

Shaft 1 now extends to more than 975 metres below surface

Shaft 1 reached the top of the high-grade Flatreef Deposit (T1 mineralized zone) at a depth of 780.2 metres below surface in Q3 2018 and has since been extended to a depth of more than 975 metres below surface. The thickness of the mineralized orebody (T1 and T2 mineralized zones) at Shaft 1 is 29 metres, with grades of platinum-group metals ranging up to 11 grams per tonne (g/t) 3PE (platinum, palladium and rhodium) plus gold, as well as significant quantities of nickel and copper. The 29-metre intersection yielded approximately 3,000 tonnes of ore, estimated to contain more than 400 ounces of platinum-group metals. The ore is stockpiled on surface for further metallurgical sampling.

The 750-, and 850-metre-level station developments have successfully been completed and the 950-metre-level station development is nearing completion. The final shaft bottom will be approximately 1,000 metres below surface and is expected to be reached in Q3 2020. The three development stations will provide initial, underground access to the high-grade orebody. Shaft 1 changeover detailed designs have commenced and will enable Shaft 1 to be configured for permanent rock hoisting.

Adam Cooper (Rock Engineering Manager) conducting an inspection of Shaft 1’s 950-metre-level station in early May, in advance of the resumption of shaft-sinking.

Tumelo (left) and Temba (right) inspect mine headlamps and self-rescue devices for shaft-sinking crews developing Platreef’s Shaft 1.

Underground mining to incorporate highly-productive, mechanized methods

The mining zones in the current Platreef mine plan occur at depths ranging from approximately 700 metres to 1,200 metres below surface. When completed, Shaft 2 is expected to provide primary access to the mining zones; secondary access is expected to be via Shaft 1. During mine production, both shafts also are expected to serve as ventilation intakes. Three additional ventilation exhaust raises are planned to achieve steady-state production.

Planned mining methods will use highly-productive, mechanized methods, including long-hole stoping and drift-and-fill mining. Each method will utilize cemented backfill for maximum ore extraction. The ore will be hauled from the stopes to a series of internal ore passes and fed to the bottom of Shaft 2, where it will be crushed and hoisted to surface.

Platreef’s Shaft 1 is now at a depth of 975.3 metres below surface. The shaft will be sunk to a final depth of approximately 1,000 metres.

Victor Skinner (Winder Technician) assembles a pumping programmable logic controller (PLC) to be installed at Shaft 1’s 950-metre-level station.

Long-term supply of bulk water secured for the Platreef Mine

On May 7, 2018, Ivanhoe announced the signing of a new agreement to receive local, treated water to supply most of the bulk water needed for the first phase of production at Platreef. The Mogalakwena Local Municipality has agreed to supply a minimum of five million litres of treated water a day for 32 years, beginning in 2022, from the town of Mokopane’s new Masodi Treatment Works. Initial supply will be used in Platreef’s ongoing underground mine development and surface infrastructure construction.

Under the terms of the agreement, which is subject to certain suspensive conditions, Ivanplats will provide financial assistance to the municipality for certified costs of up to a maximum of R248 million (approximately $16 million) to complete the Masodi treatment plant. Ivanplats will purchase the treated wastewater at a reduced rate of R5 per thousand litres for the first 10 million litres per day to offset a portion of the initial capital contributed.

Ivanplats received its Integrated Water Use Licence in January 2019, which is valid for 30 years and enables the Platreef Project to make use of water as planned in the 2017 DFS.

Development of human resources and job skills

Consultation regarding the Platreef Project’s second Social and Labour Plan (SLP) is in the final stages. In this second SLP, Ivanplats plans to build on the foundation laid in the first SLP and continue to focus on training and development, local economic development projects and enterprise and supplier development.

3. Kipushi Project

68%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kipushi copper-zinc-germanium-lead mine, in the DRC, is adjacent to the town of Kipushi and approximately 30 kilometres southwest of Lubumbashi. It is located on the Central African Copperbelt, approximately 250 kilometres southeast of the Kamoa-Kakula Project and less than one kilometre from the Zambian border. Ivanhoe acquired its 68% interest in the Kipushi Project in November 2011; the balance of 32% is held by the state-owned mining company, Gécamines.

As part of the company’s cost-cutting measures announced on April 27, 2020, Ivanhoe’s board of directors allocated a reduced total budget for 2020 of $28.7 million for the Kipushi Project, of which approximately $20.2 million remains for the rest of the year.

Health, safety and community development

At the end of Q1 2020, the Kipushi Project reached a total of 2,269,815 work hours free of lost-time injuries. It has been more than 16 months since the last lost-time injury occurred at the Kipushi Project.

In response to government-imposed travel restrictions and emergency protocols being introduced worldwide due to the COVID-19 pandemic, Kipushi has temporarily suspended mine development operations in order to reduce the risk to the workforce and local communities. The project is maintaining a reduced workforce to conduct maintenance activities and to maintain pumping operations.

Ivanhoe Mines and its joint-venture partners are committed to bringing clean water solutions to local communities near all of its mining projects. A girl from a community near Kipushi obtains fresh water from one of the new, solar-powered wells constructed by the Kipushi Mine.

The Kipushi Project operates a potable-water station to supply the municipality of Kipushi with water. This includes power supply, disinfectant chemicals, routine maintenance, security, and emergency repair of leaks to the primary reticulation. Other community development projects initiated before being suspended in response to the COVID-19 pandemic, included the Kipushi women’s literacy project, the sewing training centre project and the upgrading of the Mungoti School near the Kipushi Project.

Definitive feasibility study in final stages of completion

The Kipushi Project’s PFS, announced by Ivanhoe Mines on December 13, 2017, anticipated annual production of an average of 381,000 tonnes of zinc concentrate over an 11-year, initial mine life at a total cash cost of approximately $0.48 per pound (lb) of zinc.

Highlights of the PFS, based on a long-term zinc price of $1.10/lb, include:

- After-tax net present value (NPV) at an 8% real discount rate of $683 million.

- After-tax real internal rate of return (IRR) of 35.3%.

- After-tax project payback period of 2.2 years.

- Pre-production capital costs, including contingency, of $337 million.

- Existing surface and underground infrastructure allows for significantly lower capital costs than comparable greenfield development projects.

- Life-of-mine average planned zinc concentrate production of 381,000 dry tonnes per annum, with a concentrate grade of 59% zinc, is expected to rank Kipushi, once in production, among the world’s largest zinc mines.

All figures are on a 100%-project basis unless otherwise stated. Estimated life-of-mine average cash cost of $0.48/lb of zinc is expected to rank Kipushi, once in production, in the bottom quartile of the cash-cost curve for zinc producers internationally.

The Kipushi Project’s definitive feasibility study (DFS) is nearing completion, and some aspects of the design have already been progressed into a detailed engineering phase.

Project development and infrastructure

Although development and rehabilitation activities in Q1 2020 were limited, significant progress has been made in recent years modernizing the Kipushi Mine’s underground infrastructure as part of preparations for the mine to resume commercial production, including upgrading a series of vertical mine shafts to various depths, with associated head frames, as well as underground mine excavations and infrastructure. A series of crosscuts and ventilation infrastructure still is in working condition and have been cleared of old materials and equipment to facilitate modern, bulk-mechanized mining. The underground infrastructure also includes a series of pumps to manage the mine’s water levels, which now are easily maintained at the bottom of the mine.

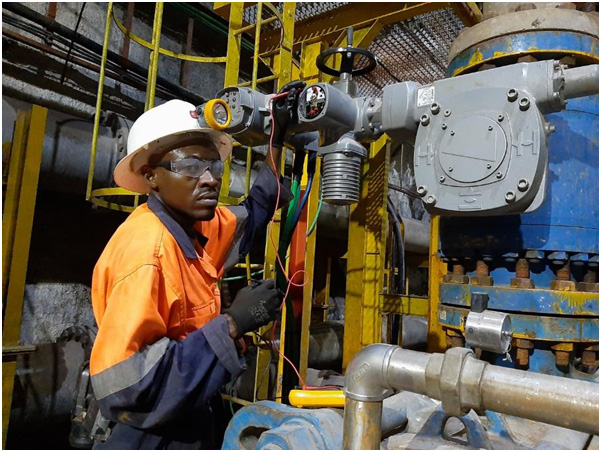

Tresor Muweji setting up the actuator (the component that turns a control signal into mechanical action) for the new pumping station on Kipushi’s 850-metre-level.

Shaft 5 is eight metres in diameter and 1,240 metres deep and has been upgraded and re-commissioned. The main personnel and material winder has been upgraded and modernized to meet international industry standards and safety criteria. The Shaft 5 rock-hoisting winder also is fully operational with new rock skips, new head- and tail-ropes, and attachments installed. The two newly-manufactured rock conveyances (skips) and the supporting frames (bridles) have been installed in the shaft to facilitate the hoisting of rock from the main ore and waste storage silos feeding rock on the 1,200-metre level.

The main haulage way on the 1,150-metre level, between the Big Zinc access decline and Shaft 5 rock load-out facilities, has been resurfaced with concrete so the mine now can use modern, trackless, mobile machinery. A new truck-tipping bin, which feeds into the large-capacity rock crusher located directly below, has been installed on this level. The old winder at P2 Shaft has been removed and construction of the new foundation, along with assembly and installation of the new modern winder, has been completed and fully commissioned after passing safety inspection and testing procedures.

Ngoi Kisula Jr., Instrumentation Engineer (left), and Sammy Wandalika, Electrical Assistant in training (right), at Kipushi’s 850-metre-level motor control centre that has a fibre optics linkage to the control room on surface.

4.Western Foreland Exploration Project

100%-owned by Ivanhoe Mines

Democratic Republic of Congo

Ivanhoe’s DRC exploration group is targeting Kamoa-Kakula-style copper mineralization through a regional drilling program on its 100%-owned Western Foreland exploration licences, located to the north, south and west of the Kamoa-Kakula Project. Exploration activities on the Western Foreland’s exploration project in DRC will continue with a 2020 budget of $8 million, of which approximately $6 million remains for the rest of the year.

During Q1 2020, the drilling program was focused within the Makoko area targeting the extension of mineralization to the east, west and south-west. Drilling was limited due to excessive rains and limited access to drill targets.

Exploration drilling at Makoko

Drilling continued within the Makoko area, located west of the Kakula mining licence. In Q1 2020, six holes were drilled for a total of 2,103 metres at Makoko. Four shallow holes (DMKK108-109-110-112) have been drilled with the Land Cruiser rigs for stratigraphic interpretation. The main objective of the drilling is to test the possible extension of the near-surface mineralization to the west of Makoko.

Two deeper holes (DMKK111 and DMKK113) were drilled by a contractor to target the extension of mineralization east and south-west of the Makoko discovery.

Drill-hole locations and geology map within the Makoko discovery area.

Geophysics to assist with target generation

A ground-gravity survey is ongoing in eastern part of Makoko to assist with target generation. Petrophysical activities were conducted during Q1 2020. The goal of this work is to understand the magnetic and density characteristics of the different lithologies and stratigraphy within the broader exploration area.

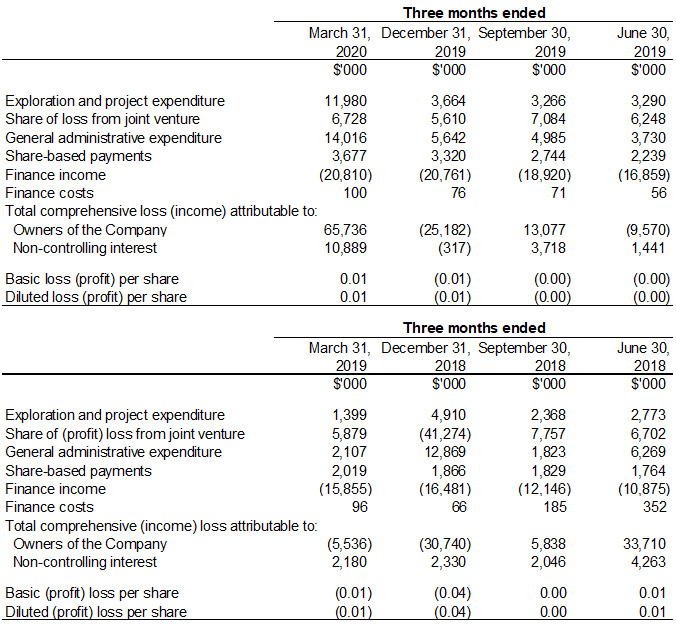

SELECTED QUARTERLY FINANCIAL INFORMATION

The following table summarizes selected financial information for the prior eight quarters. Ivanhoe had no operating revenue in any financial reporting period and did not declare or pay any dividend or distribution in any financial reporting period.

DISCUSSION OF RESULTS OF OPERATIONS

Review of the three months ended March 31, 2020 vs. March 31, 2019

The company recorded a total comprehensive loss of $76.6 million for Q1 2020 compared to a profit of $3.4 million for the same period in 2019. The comprehensive loss for Q1 2020 included an exchange loss on translation of foreign operations of $62.5 million, resulting from the weakening of the South African Rand by 28% from December 31, 2019, to March 31, 2020, compared to an exchange loss on translation of foreign operations recognized in Q1 2019 of $0.5 million.

Finance income for Q1 2020, amounted to $20.8 million, and was $4.9 million more than for the same period in 2019 ($15.9 million). Included in finance income is the interest earned on loans to the Kamoa Holding joint venture to fund operations that amounted to $16.3 million for Q1 2020, and $12.0 million for the same period in 2019, and increased as the accumulated loan balance increased. Interest received on cash and cash equivalents decreased due to US interest rate cuts by the Federal Reserve, even though the company had a higher cash balance during Q1 2020.

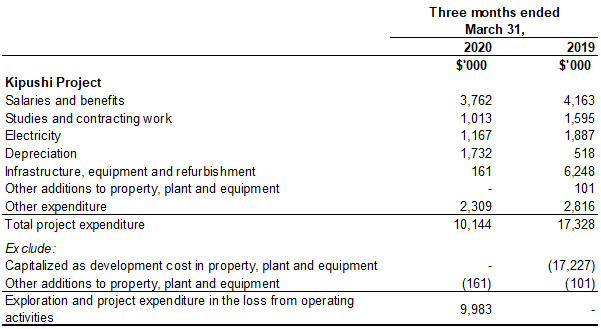

Exploration and project expenditure amounted to $12.0 million in Q1 2020 and $1.4 million for the same period in 2019. While all the exploration and project expenditure incurred in Q1 2019 related to exploration at Ivanhoe’s 100%-owned Western Foreland exploration licences, Q1 2020 also included $10.0 million spent at the Kipushi Project which was on reduced activities and incurred limited costs of a capital nature in the quarter. The main classes of expenditure at the Kipushi Project in Q1 2020 and Q1 2019 are set out in the following table:

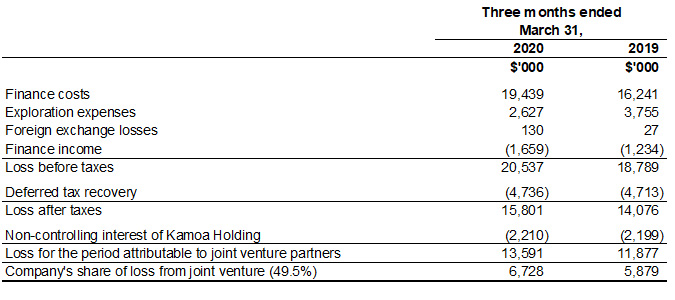

The company’s share of losses from the Kamoa Holding joint venture increased from $5.9 million in Q1 2019 to $6.7 million in Q1 2020. The following table summarizes the company’s share of the profits and losses of Kamoa Holding for the three months ended March 31, 2020, and for the same period in 2019:

The finance costs in the Kamoa Holding joint venture relates to shareholder loans where each shareholder is required to fund Kamoa Holding in an amount equivalent to its proportionate shareholding interest. The company is advancing Crystal River’s portion on its behalf in return for an increase in the promissory note due to Ivanhoe.

Financial position as at March 31, 2020 vs. December 31, 2019

The company’s total assets decreased by $79.0 million, from $2,444.7 million as at December 31, 2019, to $2,365.7 million as at March 31, 2020. The company utilized $18.4 million of its cash resources in its operations and received interest of $2.9 million during Q1 2020.

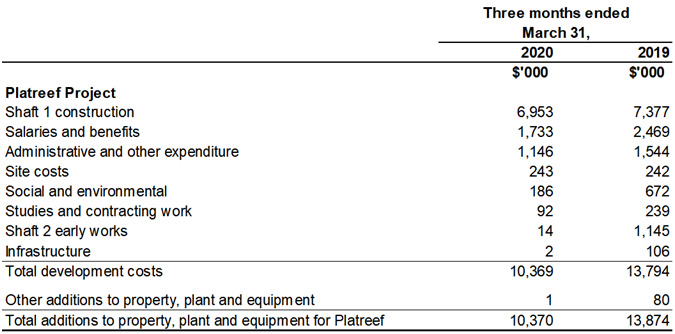

Property, plant and equipment decreased by $50.1 million, from $421.1 million as at December 31, 2019, to $371.0 million as at March 31, 2020. The decrease resulted from foreign exchange translation of $59.3 million due to the weakening of the South African Rand by 28% from December 31, 2019, to March 31, 2020. A total of $10.8 million was spent on project development and to acquire other property, plant and equipment, $10.4 million of which pertained to development costs and other acquisitions of property, plant and equipment at the Platreef Project.

The main components of the additions to property, plant and equipment – including capitalized development costs – at the Platreef Project for the three months ended March 31, 2020, and for the same period in 2019, are set out in the following table:

Costs incurred at the Platreef Project are deemed necessary to bring the project to commercial production and are therefore capitalized as property, plant and equipment.

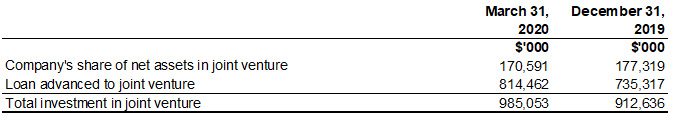

The company’s investment in the Kamoa Holding joint venture increased by $72.5 million from $912.6 million as at December 31, 2019, to $985.1 million as at March 31, 2020, with each of the current shareholders funding the operations equivalent to their proportionate shareholding interest. The company’s portion of the Kamoa Holding joint venture cash calls amounted to $62.9 million during the three months ending March 31, 2020, while the company’s share of losses from the joint venture amounted to $6.7 million.

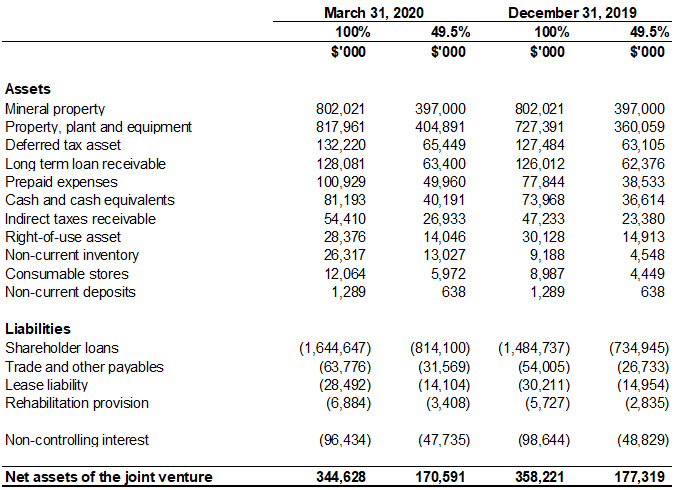

The company’s investment in the Kamoa Holding joint venture can be broken down as follows:

The Kamoa Holding joint venture principally uses loans advanced to it by its shareholders to advance the Kamoa-Kakula Project through investing in development costs and other property, plant and equipment, as well as continuing with exploration. This can be evidenced by the movement in the company’s share of net assets in the Kamoa Holding joint venture which can be broken down as follows:

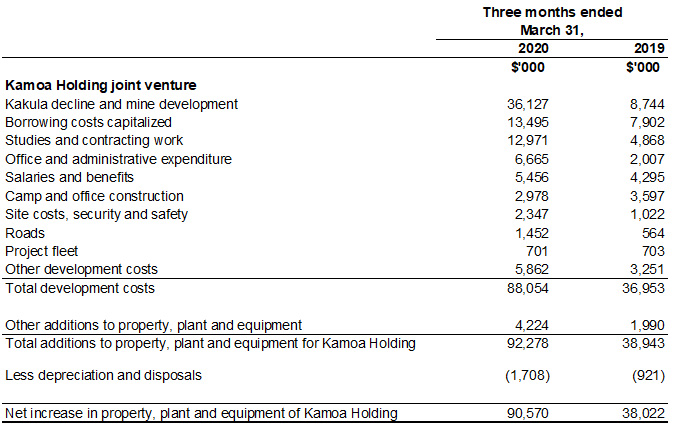

The Kamoa Holding joint venture’s net increase in property, plant and equipment from December 31, 2019, to March 31, 2020, amounted to $90.6 million and can be further broken down as follows:

The company’s total liabilities decreased by $6.3 million to $75.6 million as at March 31, 2020, from $81.9 million as at December 31, 2019, due to a $6.0 million decrease in trade and other payables.

LIQUIDITY AND CAPITAL RESOURCES

The company had $603.4 million in cash and cash equivalents as at March 31, 2020. At this date, the company had consolidated working capital of approximately $592.0 million, compared to $688.5 million at December 31, 2019.

Since December 8, 2015, each shareholder in Kamoa Holding has been required to fund Kamoa Holding in an amount equivalent to its proportionate shareholding interest. The company is advancing Crystal River’s portion on its behalf in return for an increase in the promissory note due to Ivanhoe.

The Platreef Project’s current expenditure is being funded solely by Ivanhoe, through an interest bearing loan to Ivanplats, as the Japanese consortium has elected not to contribute to current expenditures.

The company will reduce its global office footprint and its corporate and senior management headcount, in addition to implementing several other company-wide, cash-saving measures. Ivanhoe’s head office will remain in Sandton (South Africa) and be supported by satellite offices in Beijing (China) and London (United Kingdom). The company has budgeted to spend $17.8 million on corporate overheads for the remainder of 2020.

Ivanhoe’s board of directors allocated a reduced 2020 budget of $41.7 million for the Platreef Project, of which $31.4 million is allocated for the remainder of 2020, where the sinking of Platreef’s Shaft 1 will continue. The company also allocated a reduced 2020 budget of $28.7 million for the Kipushi Project, of which $20.2 million is allocated for the remainder of 2020. Exploration activities on the Western Foreland’s exploration project in DRC will continue with a 2020 budget of $8.0 million, of which $6.0 million is allocated for the remainder of 2020. At the Kamoa-Kakula Project, the priority remains the continuation of mine development work at Kakula where initial copper concentrate production is scheduled for the third quarter of 2021. The company has budgeted $337 million for its proportionate funding of the Kamoa-Kakula Project for the remainder of 2020.

As Ivanhoe continues to advance its projects, the company’s management has reviewed and assessed numerous alternatives to finance its share of construction costs for the Kakula Copper Mine and to advance exploration and development initiatives at its other projects in Southern Africa. These alternatives include, but are not limited to, existing liquidity sources, including cash, receivables and investments, selling assets, project financing, streaming or royalty transactions, equipment and debt financing. While Ivanhoe expects that it will continue to have sufficient cash resources or project-related financing options available to cover its share of the initial capital costs at the Kakula Mine, the company will continue to seek out and review opportunities presented to Ivanhoe, having regard to the best interests of Ivanhoe as well as to Ivanhoe’s operations and financial position, industry conditions and geopolitical considerations.

This news release should be read in conjunction with Ivanhoe Mines’ audited 2019 Financial Statements and Management’s Discussion and Analysis report available at www.ivanhoemines.com and at www.sedar.com.

Qualified Person

Disclosures of a scientific or technical nature regarding the revised capital expenditure and development scenarios at the Kamoa-Kakula Project in this news release have been reviewed and approved by Steve Amos, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Amos is not considered independent under NI 43-101 as he is the Head of the Kamoa Project. Mr. Amos has verified the technical data disclosed in this news release.

Other disclosures of a scientific or technical nature in this news release have been reviewed and approved by Stephen Torr, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Torr is not considered independent under NI 43-101 as he is the Vice President, Project Geology and Evaluation. Mr. Torr has verified the other technical data disclosed in this news release.

Ivanhoe has prepared a current, independent, NI 43-101-compliant technical report for each of the Platreef Project, the Kipushi Project and the Kamoa-Kakula Project, which are available under the company’s SEDAR profile at www.sedar.com:

- The Kamoa-Kakula 2020 Resource Update dated March 25, 2020, prepared by OreWin Pty Ltd., Wood plc, DRA Global, SRK Consulting (South Africa) (Pty) Ltd and Stantec Consulting International LLC, covering the Company’s Kamoa-Kakula Project;

- The Platreef 2017 Feasibility Study Technical Report dated September 4, 2017, prepared by DRA Global, OreWin Pty. Ltd., Amec Foster Wheeler, Stantec Consulting, Murray & Roberts Cementation, SRK Consulting, Golder Associates, and Digby Wells Environmental, covering the company’s Platreef Project; and

- The Kipushi 2019 Mineral Resource Update dated March 28, 2019, prepared by OreWin Pty Ltd., MSA Group (Pty) Ltd., SRK Consulting (South Africa) (Pty) Ltd and MDM (Technical) Africa Pty Ltd. (a division of Wood PLC), covering the company’s Kipushi Project.

These technical reports include relevant information regarding the effective dates and the assumptions, parameters and methods of the mineral resource estimates on the Platreef Project, the Kipushi Project and the Kamoa-Kakula Project cited in this news release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release in respect of the Platreef Project, Kipushi Project and Kamoa-Kakula Project. Additional information regarding the company, including the company’s Annual Information Form, is available on SEDAR at www.sedar.com.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

Matthew Keevil +1.604. 558.1034

Website www.ivanhoemines.com

Forward-looking statements

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of the company’s Q1 2020 MD&A.

Such statements include without limitation, the timing and results of: (i) statements regarding first copper concentrate production at the Kakula Mine in Q3 2021; (ii) statements regarding the pace of underground development at the Kakula Mine is expected to continue to accelerate as additional mining crews are mobilized; (iii) statements regarding Kakula’s high-grade stockpile is projected to significantly expand in the coming months as the majority of Kakula’s underground development will be in mining zones grading +5% copper; (iv) statements regarding the expectation that Kakula’s ball mills are scheduled for arrival in mid-2020; (v) statements regarding refurbishment of six turbines at the Mwadingusha hydro-electric power plant and associated 220-kilovolt infrastructure is progressing and that four turbines are expected to be operational by December 2020, the remaining two in Q1 2021, and the refurbished plant is projected to deliver approximately 72 megawatts of power to the national grid; (vi) statements regarding the Platreef Project’s first shaft (Shaft 1) is scheduled to be completed to a final depth of approximately 1,000 metres in Q3 2020; (vii) statements regarding a phased development production plan for the Platreef Project that targets significantly lower initial capital, to accelerate first production by using Shaft 1 as the mine’s initial production shaft, followed by expansions to the production rate as outlined in the 2017 definitive feasibility study; (viii) statements regarding the planned expansion in initial plant capacity at Kakula from 3.0 Mtpa to 3.8 Mtpa and the planned increase in the underground mining crews in 2020 from 11 to 14 to ensure sufficient mining operations to feed the expanded plant throughput; (ix) statements regarding the updated estimate of Kakula’s initial capital costs is approximately $1.3 billion as of January 1, 2019, which assumes commissioning of the processing plant in Q3 2021 and includes expanded plant capacity and pre-production ore stockpiles; (x) statements regarding the planned mining methods at Platreef will use highly productive, mechanized methods, including long-hole stoping and drift-and-fill mining, and that each method will utilize cemented backfill for maximum ore extraction; (xi) statements regarding an independent DFS for the Kakula Mine is underway with an expected completion date of Q3 2020, and at the same time, Ivanhoe expects to issue an updated preliminary economic assessment for the expanded Kamoa-Kakula combined production scenario that will include an updated Mineral Resource estimate for Kamoa North, including the initial Mineral Resource estimate for the Kamoa North Bonanza Zone; (xii) statements regarding the forthcoming Kakula DFS will incorporate detailed design, engineering and procurement, with the plans to increase the initial processing plant ore capacity by approximately 26% from 3.0 Mtpa to 3.8 Mtpa; (xiii) statements regarding Ivanhoe’s expectation that it will continue to have sufficient cash resources or project-related financing options available to cover its share of the initial capital costs; (ixv) statements regarding timing and duration of reduced activities at the Platreef and Kipushi projects; (xv) statements regarding the company targeting company-wide cash savings of up to $75 million to strengthen the current treasury; and (xvi) statements regarding the expected expenditure for the remainder of 2020 of $31.4 million on further development at the Platreef Project; $20.2 million at the Kipushi Project; $6 million on regional exploration in the DRC; and $17.8 million on corporate overheads – as well as its proportionate funding of the Kamoa-Kakula Project, expected to be $337 million for the remainder of 2020.

As well, all of the results of the pre-feasibility study for the Kakula copper mine and the updated and expanded Kamoa-Kakula Project preliminary economic assessment, the feasibility study of the Platreef Project and the pre-feasibility study of the Kipushi Project, constitute forward-looking statements or information, and include future estimates of internal rates of return, net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, estimates of capital and operating costs and the size and timing of phased development of the projects. Furthermore, with respect to this specific forward-looking information concerning the development of the Kamoa-Kakula, Platreef and Kipushi projects, the company has based its assumptions and analysis on certain factors that are inherently uncertain. Uncertainties include: (i) the adequacy of infrastructure; (ii) geological characteristics; (iii) metallurgical characteristics of the mineralization; (iv) the ability to develop adequate processing capacity; (v) the price of copper, nickel, zinc, platinum, palladium, rhodium and gold; (vi) the availability of equipment and facilities necessary to complete development; (vii) the cost of consumables and mining and processing equipment; (viii) unforeseen technological and engineering problems; (ix) accidents or acts of sabotage or terrorism; (x) currency fluctuations; (xi) changes in regulations; (xii) the compliance by joint venture partners with terms of agreements; (xiii) the availability and productivity of skilled labour; (xiv) the regulation of the mining industry by various governmental agencies; (xv) the ability to raise sufficient capital to develop such projects; (xiv) changes in project scope or design, and (xv) political factors.

This news release also contains references to estimates of Mineral Resources and Mineral Reserves. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Estimates of Mineral Reserves provide more certainty but still involve similar subjective judgments. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation (including estimated future production from the company’s projects, the anticipated tonnages and grades that will be mined and the estimated level of recovery that will be realized), which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that ultimately may prove to be inaccurate. Mineral Resource or Mineral Reserve estimates may have to be re-estimated based on: (i) fluctuations in copper, nickel, zinc, platinum group elements (PGE), gold or other mineral prices; (ii) results of drilling; (iii) metallurgical testing and other studies; (iv) proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates and/or changes in mine plans; (vi) the possible failure to receive required permits, approvals and licences; and (vii) changes in law or regulation.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to, the factors discussed below and under “Risk Factors”, and elsewhere in the company’s MD&A for the three months ended March 31, 2020, as well as unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

The company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors set forth in the “Risk Factors” section and elsewhere in the company’s MD&A for the three months ended March 31, 2020.

English

English Français

Français 日本語

日本語 中文

中文